Nationwide Pet Insurance coverage is an affordable and easy way to provide health care for your pets. This pet health insurance plan is simple to use and only requires a few simple forms to be completed. You must also submit an itemized vet bill to receive coverage. Nationwide will reimburse you up to 100% of the cost of care. Read on for more information about Nationwide pet coverage. Don’t forget to check out their wellness rewards program. You’ll never have to worry about losing your coverage due to unexpected pet health issues.

Embrace’s Wellness Rewards

Embrace’s Wellness Rewards nationwide pet insurance plan reimburses you for routine veterinary visits and other expenses that can add up quickly. It pays for vaccinations, grooming, training, and much more. Embrace is a proud member of the North American Pet Health Insurance Association (NAPHIA). The pet insurance experience is constantly improving. Embrace’s concept was born from a winning business plan at Wharton University, which later became Embrace.

Embrace’s website offers online quotes and plenty of coverage information. You can also log into the portal to keep track of claims, update policy information, and add new pets. File a claim online or by email. You can also mail in the claim if you prefer. Embrace processes claims within 10 to 15 business days. You can pay your premium upfront and avoid a monthly billing fee.

Embrace’s Wellness Rewards nationwide pet insurance plan comes with a few important differences from its competitors. Basic plans don’t cover routine veterinary procedures. Embrace only offers full coverage for dogs and cats. Other competitors allow pets of any age. However, this policy won’t cover DNA testing, cosmetic procedures, or pre-existing conditions. If you are concerned about exclusions you can purchase an additional policy.

Trupanion

Trupanion has nationwide pet coverage as an affordable way to get their pets the medical care they need. This company pays veterinarians directly for services provided to insured pets. You don’t need to pay upfront or wait for reimbursement to file claims. However, Trupanion coverage has some cons.

They cover diagnostic tests, hospital stays, drug vehicles, etc. Many medical procedures are covered at no cost to the pet owner. And, because Trupanion pays veterinarians directly, there is no reimbursement process. Its money-back guarantee makes it worth checking out.

There are some important differences between trupanion and leverage claw. Both groups have different personalities. But in general, multiple election commissions operate and are not particularly young or gender-neutral. The cost of coverage doesn’t go up as well as your pet, although it can be due to inflation or other reasons. Some important relationships are exits. Let’s consider this before buying.

Nationwide major medical plan

You should also be aware of the limitations of nationwide pet insurance. Certain conditions, such as diabetes, may not be covered. This plan limits your reimbursement for each condition. While a full pet plan limits benefits to $10,000 per year. The plan also includes a long list of exclusions, such as certain hereditary diseases or pre-existing conditions. It covers most illnesses, and may also cover preventive care.

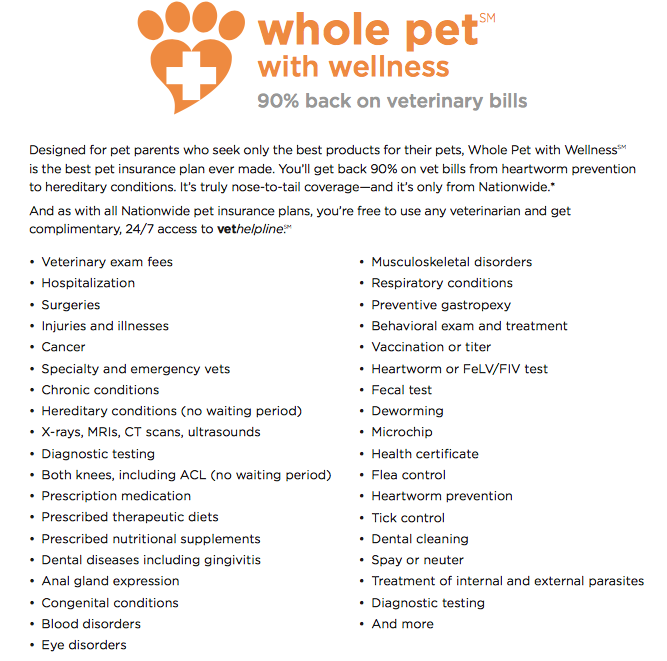

The plan covers wellness exams, vaccinations, flea and heartworm prevention, and blood tests. It also covers spaying and neutering. This plan is the best option for pet owners who want to keep their pets healthy. That’s a modest $250 annual deductible. Insurance will pay ninety percent of the vet bill. If the policy doesn’t cover everything, you won’t have to worry about paying for a vet visit.

While Nationwide offers wellness benefits for dogs and cats, a 14-day waiting period applies to major medical plans. Other providers offer shorter waiting periods. Premiums are competitive, and Nationwide customers can save 5% if they insure more than one pet with them. The nationwide website is easy to navigate with an FAQ section and claims online form. You should give yourself plenty of time to make sure the waiting period you set is acceptable.

Exotic pet coverage

Exotic pet insurance is a good idea for anyone who owns an exotic animal. These pets are very susceptible to injuries and illnesses. They require periodic veterinary care with medications and diagnostic procedures. These are the main expenses covered by most pet insurance policies. There are some exceptions. Foreign pet insurance plans can cover emergency dental care, alternative therapies, and non-hereditary cancer treatment.

If you are planning to keep a horse as your pet, you will need to find insurance that covers the horse. This type of insurance covers injuries and illnesses. It reimburses you up to 90% of eligible vet bills. Because horses are more expensive than other types of pets. You can check equine pet insurance. This type of insurance is more expensive and complicated than traditional pet insurance plans. So your animal needs to get it.