Time to choose a nationwide phone insurance policy, it is always necessary to check for additional. You can usually see the make and model of your phone. The extra you request will depend on the value of your phone, so make sure you factor this in over time. This will apply nationwide when you reply. You can also add-ons for different policies. So you may decide that your understanding is better suited.

Nationwide FlexPlus

Nationwide mobile phone insurance is a feature of the FlexPlus account. This account offers cover of up to PS1,500 for one or more mobile phones in the household. You can claim a nationwide phone number or both. You can check if your items are covered online and use the mobile app to make changes to your policy.

If you have a nationwide account with your information, you can get a free ‘FlexPlus mobile phone insurance policy’. This plan provides worldwide cover for one or more phones such as interruption and transaction cover. Nationwide FlexPlus Phone Insurance is an add-on to a FlexPlus account and does not require pre-registration of your devices.

In addition to covering a phone or two, the FlexPlus account is compatible with a range of tablets and laptops. You can add or remove Nationwide phone insurance online at any time, so it’s always with you. If you need to contact a live person, you can use their online support system. The customer service team is available Monday to Friday 8 am to 8 pm and Saturday and Sunday 9 am to 6 pm. Customers have rated Nationwide with 1.7 out of 5 stars on Trustpilot.

Another bonus of a FlexPlus account is access to the AA app. which provides instant breakdown assistance. When you are stranded, the AA will manage the recovery of your car and arrange a replacement car for you. Switching your account is quick and easy. You can get a PS100 or PS125 Switch bonus, so be sure to check this out.

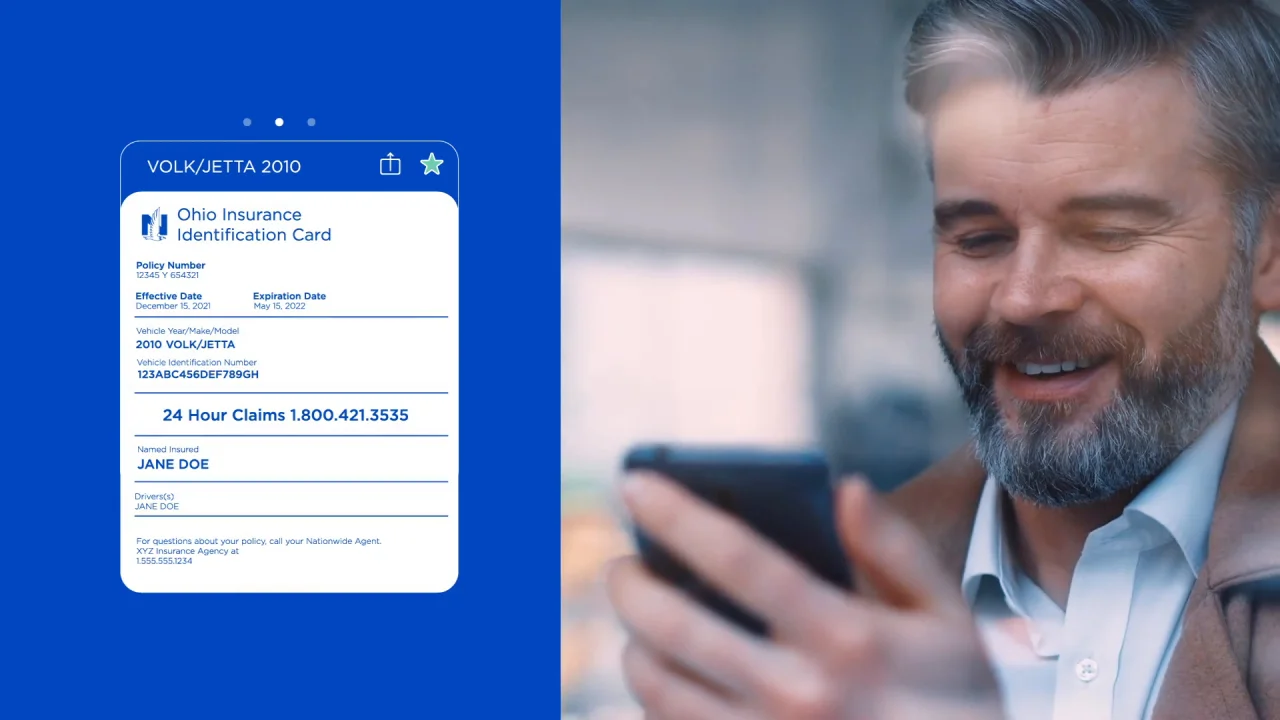

Manage your coverage effortlessly with a user-friendly nationwide mobile phone insurance login, ensuring convenient access and control

Nationwide SmartRide

With the Nationwide SmartRide phone insurance app, drivers can track their driving habits and receive a 10% participation discount. The app records driving habits and displays new discounts every week. The program also offers free prepaid envelopes for data collection. Download the app and enroll in the Nationwide Driver Monitoring Program to get started. Download the app to track your driving habits. The app will also give you feedback on your driving habits and calculate your estimated discount.

The Smart Ride Phone Insurance app works with your smartphone to monitor your driving habits. Rewards you with discounts for good driving habits. You get a guaranteed 10% discount for signing up for the program and can save up to 40% on your policy renewal if you keep your driving habits in check. You can uninstall the app after your policy period ends. The SmartRide app is easy to install. Make sure to always turn on your location services.

The SmartRide app tracks your driving for four to six months using mobile devices and apps shipped nationwide. The system offers a discount of up to 40% for safe driving, and the discount is good as long as you own your car. SmartRide also gives you a dashboard to see your estimated renewal discounts by week. Drivers can also read user reviews of the app. And it can determine how helpful it is to their driving habits.

Nationwide FlexPlus stands out as a banking choice. Which provides nationwide mobile phone insurance reviews. This includes Nationwide mobile phone insurance claims.