Some PPO networks offer national network coverage. CareFirst, UnitedHealthcare, and Blue Cross Blue Shield of Alaska all offer nationwide PPO networks. Which one is better? What are the benefits? How can you decide if one of these is the right choice for you? Read on to find out! And remember that whichever PPO network you choose. Make sure you read the fine print you sign up for. It will save you time in the long run!

Choosing the right nationwide PPO network can be an important decision for your healthcare coverage. Multiplan insurance providers offer PPO plans. Like PHCS Insurance, which is known for its extensive network of healthcare providers.

Cigna’s nationwide PPO network

The Cigna national PPO network includes nearly 6,000 hospitals and nearly 800,000 PCPs across the United States. Tufts Health Plan offers in-network benefits in New Hampshire. Its network is vast and includes nearly five million providers. Members of the Cigna PPO network are required to use providers in the Tufts Health Plan network for in-network benefits only.

The Cigna PPO network is made up of contracted healthcare providers. Those who accept the company’s Medicare Advantage plans. Ratings are based on partial evaluations of quality and cost-effectiveness. While these ratings can help you choose a therapist. You should always consult with your healthcare provider. The provider you choose is an independent contractor. Cigna’s PPO network includes doctors and hospitals in the United States and Canada that are held accountable for the quality of their services.

While Cigna does not publish average claim response times. The company’s website allows customers to track their claims online. Customers can contact Cigna representatives by phone or email 24 hours. Customers can interact with Cigna through social media and its robust member portal. Its mobile app is beneficial for consumers seeking information. It is possible to find out if Cigna’s nationwide PPO network is right for them by using Cigna’s website.

Cigna National PPO Network has a low complaint rate and is trusted by many people. As of March 2019, Cigna has more ten million US residents in Medicare. There are 31 other pharmacies in the network. To learn more about the benefits and limitations of Cigna plans, contact your local Cigna representative. They can answer your questions and help you choose the right plan for your needs.

CareFirst PPO network

A care insurance plan offers many benefits. CareFirst’s nationwide PPO network allows you to use any provider in the country even if it’s outside the Care network. If you need a specialist, you can use a referral from your care provider to make an appointment after receiving medical care from your primary care physician. Blue The Preferred PPO Gold 500 Plan meets Diane’s needs thanks to its national network and easy access to 95% of doctors in the US.

CareFirst Blue Choice Advantage plans allow members to see any provider. Not just in the CareFirst network. Out-of-network care usually costs more. The member must pay the deductible the co-insurance each time the provider deals with them. CareFirst offers two networks, the JHU Preferred Physician Network and the CareFirst PPO/Blue Choice Advantage Network. You can visit providers outside of your PPO network. you can get the same benefits as a member of the BlueChoice Advantage Network.

The BlueChoice network provides medical care in your local area. For those outside your local area, the CareFirst online directory lists BlueCard PPO providers. CareFirst POS plans to provide nationwide access to prescription drug plans insured by CVS Caremark. A participant will receive two cards with the CareFirst PPO network. Includes about 68,000 providers in the US and DC. The BlueCard PPO network includes all CVS retail locations.

UnitedHealthcare’s PPO network

For individuals and families with Medicare, UnitedHealthcare’s online plan recommendation tool can narrow down choices by showing the best-fit plans for their needs. It takes into account personal preferences specific doctors, medications travel habits to provide personalized recommendations. their extensive network, UnitedHealthcare’s plans come with free house calls and virtual visits through the telehealth company. UnitedHealthcare has partnered with AARP. To give AARP members access to online programs that promote brain health.

UnitedHealthcare’s Choice Plus network allows individuals to use any licensed provider. In-network providers have lower co-payments, deductibles co-insurance amounts non-network providers. individuals do not need to submit referrals for specialist care if they choose an in-network provider. They should be aware that UnitedHealthcare’s PPO network may vary from market to market.

Blue Cross Blue Shield of Alaska’s PPO network

In the individual market, Premera, the largest health insurer in Alaska, has a national PPO network. As the largest health insurance company in the state, Premera has earned the right to set the benchmark for essential benefit plans. Which will start in 2014 under the Health Reform Act. Their plans are a great example of how the Affordable Care Act has made the individual market more competitive.

As of December 2018, more than 70 percent of Alaska residents have health insurance. The average premium for a family of four in 2008 was $13,383. This was a high national average for employer-sponsored health plans. State health insurance exchanges offer low-cost private health plans for individuals and families without employer coverage. Buying a health insurance plan can be less expensive. It comes with high deductibles and high out-of-pocket maximums. MoneyGeek compared Exchange PUF’s Alaska health insurance plans.

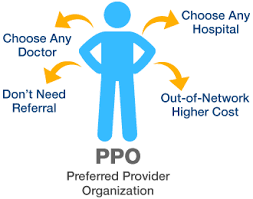

advantage of PPO plans is flexibility. Patients can visit any physician or hospital accepting the insurance plan. They will not need a referral from their primary care physician. They can choose specialists outside the network. Preferred providers typically charge more out-of-network providers. You don’t have to choose a primary care physician or specialist.