Are you in the market for nationwide PPO plan? If so, you have come to the right place. You’ve seen how these plans are cheaper than Obamacare, and now you can get a nationwide network of doctors at no extra cost. However, these schemes have many advantages. Here’s a look at the top two:

Delta Dental offers its Delta Dental Premier and Delta Dental PPO plans

The benefits and network of dentists offered by the Delta Digital Premier program make it a great option for those looking to save money on dentist visits. The plan reimburses participating dentists for both preventive care and core services. Most dentists in the Delta Dental Premier Network participate in the program. Members of these plans can expect to pay more than $50 for basic dental care and up to $1,500 for major dental services.

PPO plans, meanwhile, offer a unique combination of choice and cost-saving incentives. Dentists within the Delta Dental Premier network have agreed to accept reduced plan fees, lower out-of-pocket costs for plan members, and lower claims costs for employers. In addition, Delta Dental PPO members gain access to two (2) dentist networks nationwide – the Delta Dental Premier Network and the Delta Dental PPO Network.

As the largest dental insurance company in the United States, Delta Dental operates 39 independent insurance companies serving 80 million people. Its HMO and PPO dental plans include more than 150,000 participating dentists nationwide.

The network is made up of more than one dentist in each state. This means you can find one that works for you in your area. Delta Dental also accepts all Minnesota dentists as part of their network. This allows dentists to see more patients and provide better service to Delta Dental enrollees. The network also offers discounts on other dental services and products. Whether you choose a Delta Dental PPO or a Premier plan, you’ll always be able to find a dentist who accepts the plan.

For those looking for a dental insurance company with a national network, Cigna is an excellent choice. It has an A rating with Standard & Poor’s and AM Best. Its customer service is available round the clock. Its dental insurance plans for individuals and families have no copays or deductibles for preventive care. Some Cigna plans also offer restorative care and orthodontics.

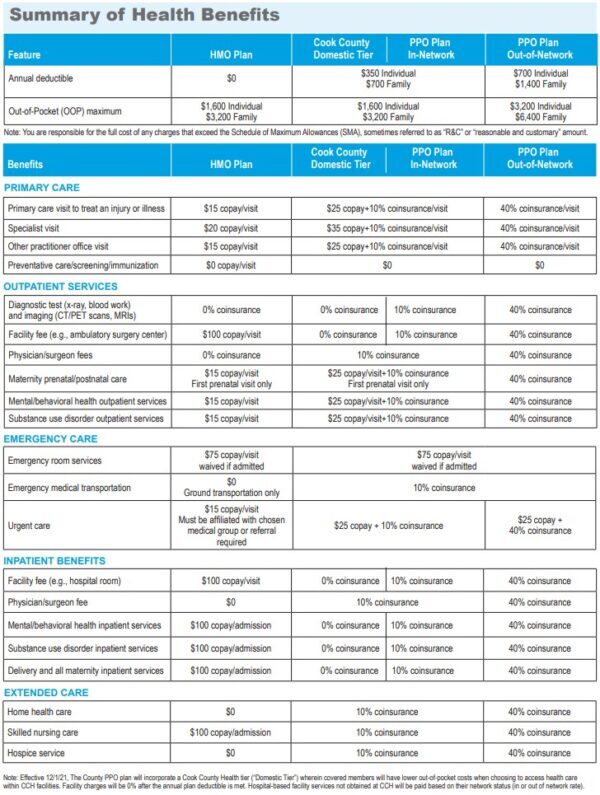

Nationwide PPO plan reviews highlight varying costs based on premiums, deductibles, and copays.

United offers its PPO Choice and LifeStyle Series plans

UnitedHealthcare Options PPO health plans allow you to use any doctor, clinic, hospital, or other facility in the network. The UnitedHealthcare Choice Plus network is a national network. You can use any provider in the United Healthcare network, without getting a referral from your primary care physician. Your out-of-pocket cost for the visit will depend on the provider. THN and Cone Health network providers offer lower out-of-pocket costs than UnitedHealthcare’s in-network providers.

Costs vary based on premiums, deductibles, and copays. Both plans receive positive reviews for their PPO nationwide coverage and network options.

For nationwide dental insurance login, Delta Dental provides a user-friendly online portal. In-network providers may be found, claims can be tracked, accounts can be accessed, and coverage details reviewed.

Tufts offers its Exclusive Provider Organization network

For those in need of medical care, Tufts offers Medicare Advantage and Special Needs Plans, including dual-eligibility plans for Medicare and Medicaid. Tufts Medicare Advantage plans are Health Maintenance Organizations (HMOs) that allow members to use a network of providers. Visiting a provider outside the HMO network may cost more. Some Tufts Medicare Advantage plans also include Part D prescription drug coverage.

A Tufts Health Plan member must pay a $20 co-payment for services provided by a Tier-1 primary care physician. If a member chooses a Tier-3 physician, they have to pay a co-payment of $50. Similarly, outpatient surgery will cost $250 at a Tier-1 hospital and $1,500 at a Tier-3 facility.

To receive the highest quality of care, members should choose the Tufts Health Plan that best meets their needs. Tufts Health Plan offers a Medicare Advantage plan to Massachusetts residents. Tufts Medicare Advantage Plan has been rated 5-star by Medicare since 2016. This article has not been independently reviewed by the Health Insurance and Medicaid Services Administration or the State of Massachusetts. If you have a Medicare Advantage plan, be sure to ask your provider about Tufts’ network before purchasing it.

Nationwide ppo plan review highlights varying prices based on premiums, deductibles, and copays, with many praising the extensive coverage and network options.