If you’re looking for a level-term life policy that doesn’t change returns during the policy term, look no further than Nationwide. A nationwide term policy guarantees payment of death benefits. And it is available in various terms including 10, 15, 20, and 30 years. Nationwide’s term policies are also convertible, which means that you can convert them to permanent coverage at any time.

Decreasing Term – Nationwide Term Life

Reducing term-life coverage is an option available to consumers in various forms. It can provide coverage for debts. Support for the family may be available. And can reduce premiums. A declining term life policy also helps prevent consumers from paying more for coverage than they need. In some circumstances reducing term life insurance policy is not a good option. In such circumstances, a traditional life insurance policy or a CD strategy is a better option. The latter allows consumers to pay the same premium for a lower amount of coverage.

Decreasing term life insurance is less expensive than level-term insurance because the death benefit goes down every year. The reason is that decreasing term life insurance reduces the risk to the life insurance company. As the death benefit decreases, so do premiums. Decreasing term life insurance is also often cheaper, but may not be right for you. Unlike level-term life insurance, decreasing term life insurance does not convert to a permanent policy.

Reduced-term life insurance is also known as mortgage protection insurance. The death benefit of this type of policy decreases over time. Over time, it decreases annually until the policyholder no longer needs it. As a result, this type of insurance may be the best option for those with a low-risk lifestyle. These policies are also available for people with high credit scores. There are many other types of life insurance, and a decreasing-term policy may be right for you.

Decreasing-term life insurance is a temporary solution for specific financial needs. In most cases, its purpose is to cover loans or outstanding debts. These policies are also sometimes known as mortgage insurance and DTA insurance. In addition, you can designate who will receive the proceeds from your policy. Regardless of your reasons for purchasing a policy, it will provide a much-needed income to your family in case of your death.

Guaranteed level amount – Nationwide Term Life

The level sum assured of a nationwide term life policy can be a great way to secure your family’s future. These policies are available in various terms ranging from 10 to 30 years, and you can choose a policy with a term that fits your budget and lifestyle. In addition, you can renew your policy annually until you reach age 95 or convert to a permanent policy. However, before you purchase this type of insurance, you should know how much coverage it will offer.

A Nationwide policy illustration allows you to see an illustration that displays an estimated projection of your policy’s values over time. You can see this picture at the time of application or even after the policy is issued to you. In the illustration, you’ll select the amount of Premium you pay, how often you pay it, and the assumption for your Investment Experience. It is important to remember that premiums and investment experience are not guaranteed. These variables fluctuate and rarely stay the same year after year, and they can even be negative.

When you purchase a Nationwide life insurance policy, your beneficiary will receive Death Benefit Proceeds if you die before the policy expires. There are some important differences between this insurance policy and other policies. If you are switching life insurance policies. So you should carefully compare it with your existing policy. While a nationwide policy may seem like a great option, it may not be the best choice for your situation.

Nationwide’s fixed account liabilities are backed by its general account assets. This account is the main foundation for all of Nationwide’s insurance and annuity obligations. The amount of money Nationwide invests in this account is entirely within its discretion. Moreover, the policy owner does not share the investment experience of the general account assets. All investment risks are borne by Nationwide. It is important to understand that your policy will be worth more when you retire than when you purchased it.

Terminal illness riders

Terminal illness riders on Nationwide Term Life policies give sick people the option to withdraw some or all of their death benefits before they die. Under these conditions, the policyholder can withdraw up to $100,000 or 50% of the death benefit even if healthy. And the balance is paid to their beneficiaries. Depending on the type of policy, these benefits can be very helpful in times of financial distress. Listed below are the most common terminal illness riders on nationwide term life policies.

Nationwide term life insurance policies come with free critical illness, chronic illness, and terminal illness riders. While these riders are not standard in term policies, Nationwide’s average-priced term policies do offer good value. You can also find policies with additional riders for chronic illnesses and disabilities. Nationwide term life insurance policies are among the best options when you’re looking for affordable coverage. You’ll enjoy competitive rates in most classes of health, including good value for money.

One option that allows you to customize your policy is to add a terminal illness rider. These policies allow you to receive your death benefit at an early age if you become terminally ill. The benefit amount, however, depends on your age, sex, and other policy values. The rider will reduce your death benefit depending on your age, sex, and other factors. Some policies also allow you to exercise this benefit if you have a spouse who is not terminally ill.

Another option to consider when choosing a term-life policy is an accelerated death benefit rider. This rider allows you to receive a portion of your death benefit while you’re still alive. This can be helpful for your family in preparing for the event of your death or needing end-of-life care. You’ll have enough money to pay bills and take care of your family. This option is usually included with Fidelity Life policies.

Waiver-of-premium rider

If you are concerned about the cost of your life insurance policy, consider taking out a waiver of premium rider. This policy feature allows you to skip paying a premium for the policy period. Which is usually between 10 to 20 percent. The advantage of this type of rider is that you can use the money to pay other expenses. Likewise, this rider will save you money if you have a high-risk business.

You should keep in mind that this type of policy may have a certain waiting period before the rider is activated. Many carriers require a 30- to 90-day wait before the policy becomes active. And some even ask for evidence of actively job-hunting or receiving unemployment benefits. You should also note that these types of policies do not cover pre-existing conditions, and therefore you should be aware of any such requirements before purchasing a policy.

The Waiver-of-premium (WOP) rider is one of the most popular types of life insurance and is a popular choice for those who wish to pay lower premiums. This type of policy lets you pay a lower premium and has no caps on the amount you can earn. Additionally, you can choose your payment frequency, from monthly, quarterly, or semi-annually.

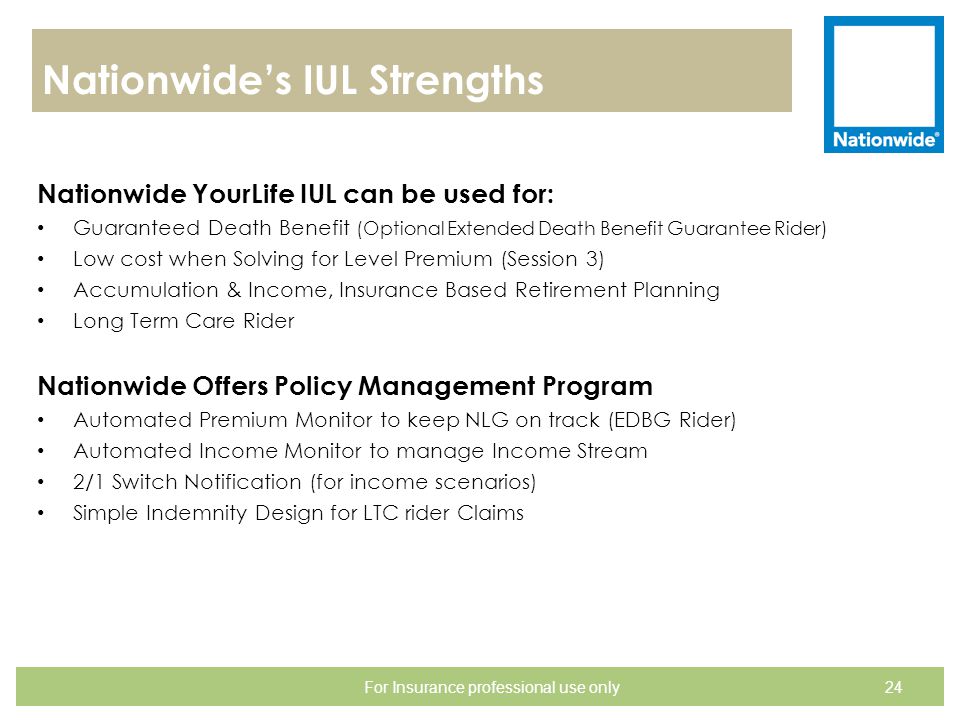

Nationwide term life insurance offers a long-term care rider, which pays out in several other ways. It can offset the cost of nursing homes, or provide money for in-home care for an elderly loved one. Moreover, you should inquire about the specific rules and regulations of long-term care in your condition, and seek advice from your agent. In addition to long-term care, a chronic illness rider permits you to request an early death benefit from your policy. It can supply you with the money you need to survive until your insurance policy ends.

Renewal options

If you have recently purchased a nationwide term life insurance policy, you might live wondering if you can renew it. The answer is yes, but only under certain circumstances. For example, you may not be able to renew your policy if you have recently undergone a divorce or have had a health issue. In such instances, you should consider getting a different type of policy. Depending on the type of policy, you may be able to renew it annually, but it will cost more.

Some companies will offer you a choice between two different policies: a term life policy and a universal life insurance policy. However, some companies only offer one type of policy for conversion. Those who opt for a period or entire term policy may be able to convert it to a UL policy before it expires. If you are concerned about insurability, you can choose a specific age conversion.

Nationwide’s products are designed to suit a range of risk tolerances and investment goals. A great example of one of their policies is the CareMatters plan, which combines life insurance and long-term care benefits. This way, the investor can plan for their own future healthcare needs. While also guaranteeing a nest egg for their family. A great example of a life insurance policy that is also a long-term care policy is the 20-pay nationwide whole life insurance. After twenty years of premium payments, the policyholder can become premium-free.

If you are young and in good fitness, annual renewable term life insurance may be the best choice. The premiums for this type of insurance will initially be lower than the annual renewable version of term life insurance. But as you age, the premiums will increase. It is also important to note that the term of an annually renewable term life insurance policy is limited to ten years instead of a lifetime. Likewise, the payout may be higher than the annual renewable version of term life insurance.