Get a personalized Progressive car insurance quote today. There is a list of discounts when you install its Popshot driving app. Including 55 of free debate and budget. The company is a price finder, which names your price before you buy. who are also members of the Finder Advertising Review Board. Some first progress quotations are worth adjusting. Its viewers have the scope to make various adjustments on its website and name a specific price before purchasing it.

Rates

If you’re looking for car insurance, you’re probably wondering what the best rates are for Progressive. If you have good grades, you can have multiple cars. Maintaining a low accident record can qualify you for several discounts.

Complaints about insurance companies are a common source of confusion. But the truth is that complaints are an essential part of any insurance company’s operations. According to the Better Business Bureau, Progressive’s average complaint ratio is 0.75. Which is much lower than the national average of 1.16. You can find the best progressive car insurance rates based on your needs and budget.

Overall, progress is made. The company performed above average for several key metrics such as customer engagement. The overall total remains restricted and is one of the highest in the US with more than 80 lavas. Their website is easy to use, with tabs and drop-down menus. Each tab leads to more information.

In general, states with milder weather and lower crime rates have lower progressive car insurance rates. In a state with a high risk for severe weather, it is unlikely that you will need to make many car repair claims due to severe weather. If you live in a desert or arid area, you may have to pay more for coverage. The difference is not as drastic as you might think. Just remember to shop around for the best rates.

Coverage options

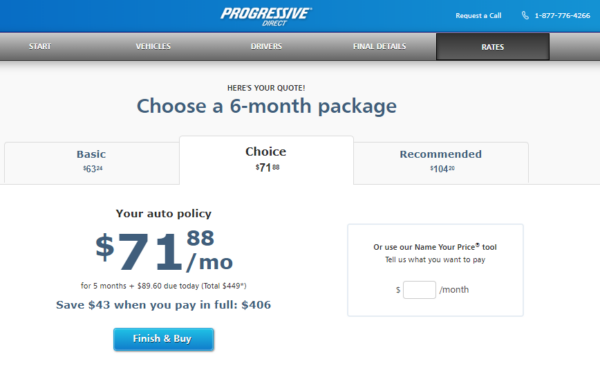

If you’ve been shopping for car insurance, you’ve likely heard about the many different coverage options available through Progressive. Among those options is the “Name your price” option. Which lets you choose the coverage level that suits your price range and your budget. Another benefit of progressive car insurance is that you can’t raise your rate if you’ve had a minor accident, as long as it’s your first claim and the damage is less than $500. You can also avail accident waiver, which helps you ensure that your rates never go up in case of an accident.

In the US, Progressive is the third largest progressive auto quote company nationwide, behind USAA and Farmers. Their coverage options are varied, and many discounts are available to customers. Customers rate Progressive as an A+ company in most categories, but J.D. They scored below average in a study conducted by Power & Associates.

Customer service

You can contact Progressive Car Insurance customer service to ask questions about your policy. Customer service representatives at Progressive don’t get a commission, so they’re unlikely to try to sell you into a more expensive insurance plan if you’ve never had one before. You should also know that they provide 24/7 customer service.

When you buy car insurance from Progressive, you agree to pay at least six months upfront. If you miss a month, you can request a 10-day extension. Progressive renewals don’t erase past delinquencies until closer to the due date, so it’s important to get your payments on time. But, don’t wait until the renewal date to request a waiver. It is best to notify the customer service representative in advance. You will not be charged any late fee for that particular month.

If you have any complaints regarding payment, you can also contact Progressive Car Insurance customer service representatives on their social media pages. You can also contact them through their website, phone number, and online chat. If you’re dealing with an agent over the phone, you can make notes so you can review the conversation and clarify what went wrong. If there was a miscommunication, the next agent may have more training than the one who answered your call.

In addition to providing 24/7 customer service, Progressive also offers a Name Your Price feature. Progressive car insurance quotes allow you to compare different coverage options and costs for a single policy. These quotes, however, are not binding, and you should verify them with a licensed Progressive agent before signing up. It is a plus when it comes to the benefits of car insurance.

Discounts

If you are shopping for car insurance, you should take a look at the various discounts offered by Progressive. Many drivers benefit from discounts with a good student, homeowner, or defensive driving record. You may also get a discount if you install an anti-theft device.

Other discounts offered by Progressive include homeowner discounts, multi-policy discounts, and driver education. If you are a student, you can take a defensive driving course or enroll in driver’s education. For those who own more than one vehicle, you can also avail of auto insurance discounts for students. You can also save money if you own your car and install an anti-theft device. You can also get a discount on your car insurance premiums if you have multiple car insurance with the company.

If you have a history of dangerous driving, progressive DUI offers the fourth-best rates for motor drivers. While this is good news for drivers who need them. Keep in mind, remember that these rates are higher than the average meditation. Drivers who have also taken courses in college are also eligible for their number certificate discount. Remember that rates are based on zip code, driving record, and coverage preferences. As with all V plans, everything may be needed for the best rate.

Another popular discount offered by Progressive is the “sign online” discount. This discount allows you to sign documents online and the average savings with this discount is 9% or more. This discount is especially valuable if you pay for your insurance online. That includes more than one million people who watch Progressive Car Insurance commercials.

Auto insurance calculator

While Progressive ranks high for minimum coverage rates, its prices can be too high for young drivers. Rates for this age group are typically 50 percent higher than the national average. Parents of teen drivers should be aware that rates vary from driver to driver and can vary based on zip code, driving history, and other factors. If you have a clean driving record but a poor credit score, you may find Progressive cheaper than the national average. you can

In exchange for a lower monthly payment, you can get a discount of up to 30 percent by completing your application online. You can also sign your policy documents online if you wish. Progressive also offers a good student discount if you are a good student. Another discount is for drivers with a B average. For teenagers, adding them to your policy is cheaper than buying a separate policy. Additionally, your teen will be insured for all your vehicles.

Progressive offers a student discount of up to 10 percent for college students. If you are a full-time student, you can save an additional 10% by paying for your policy online. Many customers receive discounts for paying their premiums in advance. Overall, customer service at Progressive is above average, according to the BBB and NAIC. Despite this, the Better Business Bureau does not rate the company.