Renewable term life insurance can provide coverage for several years at an affordable rate. Alternatively, upgrade to a level term or permanent policy for more comprehensive coverage. This option may be more beneficial for your situation than a level-term policy. Let’s take a closer look. We will explain the differences between YRT and ART policy.

Annual renewable term life insurance

If you’re in the market for life insurance, an annual renewable term policy may be right for you. If you’re looking for a term life policy that keeps renewing, it’s important to understand the premium rate and how it works. This policy works well for short-term protection and can help you plan for the future. However, you should first ask yourself what coverage you need.

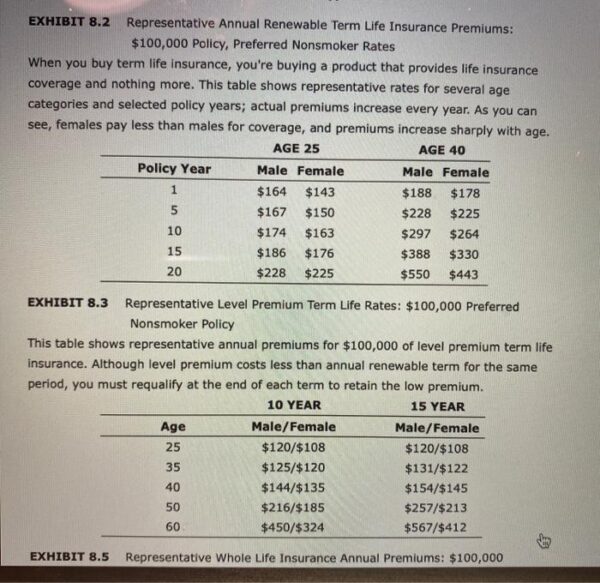

One of the advantages of annually renewable term life insurance is its flexibility. This policy is renewed every year without any health check or medical examinations. Moreover, premiums will increase as you get older. However, the death benefit will remain the same. Therefore, it is important to get multiple quotes and compare them. To better understand the features of this insurance, it is important to compare it with the cost of a level term life insurance policy.

Non-smoker rates are also available with annually renewable term insurance. You must be a non-smoker for 12 consecutive months to qualify for the non-smoker rate. However, after one year of non-smoking, you can upgrade your policy to a 10-year policy. If you decide to purchase annual renewable-term life insurance, be sure to keep the factors listed below in mind.

An annual renewable term life insurance policy is a flexible type of life insurance policy. It will cover most of your debts if you die within a certain time frame. If you’re buying a mortgage, you may need a 20-year policy to cover college costs. If you die early, you can convert your policy to a 30-year term life policy. However, you have to consider the premium cost of annual renewable term life insurance.

YRT policy

The most common difference between a YRT policy and a level term policy is cost. YRT premium is cheaper when you buy the policy in advance. But this may change over time. Level term policy premiums increase with your age and YRT policy rates increase with age.

A YRT policy is an annually renewable term life insurance policy. Depending on your age, you can buy a renewable term life insurance policy without any medical exam. Annually renewable term life insurance is usually cheaper than a standard term policy, and you can renew it as often as you like, even if you get sick. However, if you fall ill or lose your job, your policy will not be renewed.

A YRT policy is similar to a level term policy, except that the premium increases every year. The cost of the policy may increase or decrease depending on your health. A YRT policy can be used as a means of paying off liabilities gradually. Generally, you pay the level premium for one year and then decide whether to renew the policy or not. Once you reach the age of 65, you can choose to renew your policy.

Another difference between level-term policies is the type of cover. A level-term policy offers the same level of cover as a YRT policy. But the premium remains the same every month. This is a good option for young, healthy individuals who don’t mind paying higher premiums. However, if you are concerned about rising insurance costs, a level-term policy may be a better option.

ART policy

ART policies for renewable term life insurance have many advantages, but also some disadvantages. While the initial premium on an ART policy is low, it increases year by year as you age. Further, the death benefit will not decrease over the life of the policy. ART policies also have a premium schedule, which limits the amount by which the insurer can increase its premium each year.

The primary reason most people opt for an ART policy is for short-term needs. Many people choose it for short-term needs such as covering a mortgage, meeting a court order to purchase life insurance, or financing a temporary, high-risk job. ART coverage is a better option for those who need temporary coverage and may cost more than a traditional term policy.

One disadvantage of an ART policy is that you have to renew it every year. If you don’t want to face this hassle, opt for a long term policy. Some providers offer renewable policies for thirty years, which can automatically convert to an ART policy. A long-term policy is also a good option for people who are not sure what type of life insurance they want. In this way, they may have time to consider other policies.

ART policy for renewable term life insurance is a good option for people who need annual coverage for 10-30 years. ART policy will increase your premium every year according to your age. Additionally, you don’t need to prove your health, which can be a huge advantage in the event you die prematurely. It will also cover the cost of health related expenses. An annual renewable term life policy may be expensive initially, but you will save money in the long run.