Whether you’re shopping for a term life or permanent life insurance policy, there are many factors to consider when comparing rates and services from different companies. You can also find information about the minimum age to apply for a policy and licensing requirements. This article will cover some of the most important factors when choosing a life insurance company. Read on to learn more. Despite its name, Securian is a life insurance company that operates in all 50 states. Its policies offer a range of coverage options, including term life, permanent life, and variable universal life.

Securian Life Insurance Company rating

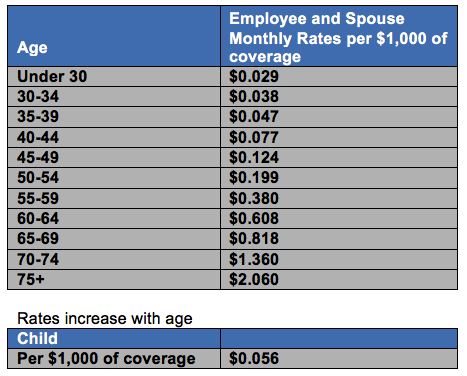

You may wonder if Securian Life Insurance Company rates are competitive when looking for life insurance. While many insurance companies offer online quotes, Securian does not. Instead, you should speak to a financial advisor in your area to get a quote. Premiums are determined by age, gender, health, and family history. Because of this, it’s important to compare quotes. Although Securian doesn’t offer competitive quotes online, its term rates are comparable across the board and are the most affordable for people over fifty.

While Securian Financial has been around for 140 years, it underperforms its competitors when it comes to customer satisfaction. In the 2021 J.D. Power Individual Life Insurance Study, the company ranked 769 out of 1,000. While the company is in the top 20 among carriers, the company’s overall satisfaction score is below the industry average. The company’s website is easy to navigate and provides plenty of information about its history and operations. The company also has a wealth of educational blog content. Despite this, the website does not provide enough information on policies and coverage options.

When comparing life insurance rates, it’s important to consider the type of coverage you need. Fortunately, Securian offers two variable universal life policies. The Premier VUL is available to people ages 0 to 85, has a minimum of $100,000, and offers the option to increase or decrease the death benefit. It’s also possible to invest money through the Premier VUL, which offers investors five different fixed index accounts. The Premier VUL offers low surrender charges and guaranteed interest rates for the first ten years.

Customer satisfaction

If you’re a life insurance customer, you’re probably well aware of the importance of a good customer service experience. You’ve likely had some positive experiences with your life insurance provider, so you can offer a firsthand perspective. A survey conducted by J.D. Power measures your satisfaction with your life insurance provider. They assign scores out of 1,000 to each company based on their customer satisfaction. If you’re happy with your life insurance company, it’ll be easy to figure out if Secure Life Insurance Company is the right choice for you.

A recent survey found that life insurance and annuity customers are equally satisfied with Secure Life Insurance Company, although their ratings decline with tenure. Customers with less than five years with the company are the most satisfied. Scores drop by 27 points for customers with six to ten years of service and by 46 points for customers with more than 20 years. Annuity customers, however, are generally happier, but satisfaction depends on the types of payments you receive from the insurance company.

Overall satisfaction with a life insurance company can be explained by three factors. Assurance, competitiveness, and functional services can affect satisfaction with a life insurance company. Personal financial planning is also a major factor that influences customer satisfaction. Customers also have a positive attitude towards their insurance agent. But what about the company itself? How do customers feel about the people they work with? In this article, we will examine these factors.

Securian Life Insurance Company earns favorable reviews for customer satisfaction, with many highlighting its responsive Securian Life Insurance customer service.

Licensing

A life insurance company’s license depends on its state of origin. Securian Financial is a life insurance company that offers term life insurance, permanent life insurance, and hybrid long-term care insurance products. These products are designed to provide an individuals with the amount of life insurance they need without the need for any additional underwriting. Qualified applicants can complete a detailed phone interview and avoid the need for a medical exam through the WriteFit underwriting program.

Securian does not offer guaranteed life insurance plans, but it does offer no-medical-exam underwriting. They offer term, indexed, and universal life insurance policies, and their WriteFit program offers no-medical-exam underwriting for healthy seniors. They also offer a unique universal life policy that combines the benefits of universal life with long-term care and chronic illness coverage. If you stop paying your premiums, the policy will terminate with a refund of the premium.

Pre-licensing coursework includes a state-approved test for each line of insurance. In Minnesota, the exam covers life, health, and accident (LH&A) insurance. In most states, the exam is combined. The tests are proctored. Students must complete a nerve-calming exercise before taking the exam. Depending on state requirements, a life insurance agent may also be required to obtain a securities license to become licensed.

These licenses authorize Minnesota Life Insurance Company to offer life insurance, annuities, and related financial products.

Minimum age to apply

If you have a loved one under the age of 65, you can apply for Part A of Security Life Insurance. Part A begins the month you turn 65, so it’s important to apply within a specific timeframe. For example, if you turn 65 on December 31, your coverage will begin on January 1 and will be retroactive for six months. If you file your application on January 1, you will begin receiving payments on the date you turn 65.

The age limit for applying for life insurance depends on the policy. Typically, people on SSDI or other government benefits can apply for guaranteed life insurance. This type of insurance offers coverage of $25,000 and requires a minimum age of 50. The only exception to this rule is if you have suffered a physical injury. If you think your age will prevent you from getting coverage, you can always check with the Life Insurance Commission to see if you can get a lower rate or better terms.

Health questionnaire

If you don’t have a group policy through your employer, you may be able to apply for individual coverage from Securit Financial. To do this, you must have been a member of your company for at least six months. You can then apply for coverage in an amount that is less than the group policy or an amount that is equal to the group rate. You must pay your first premium within 31 days of your group coverage ending.

To make the application process even easier, Securian Financial has expanded its Secure Insights(TM) tool to help employers identify critical gaps in coverage. It also assesses the financial preparedness of the employee population in a variety of areas, including critical illness, unreimbursed medical expenses, hospitalization, and accident coverage. This questionnaire is a great starting point for assessing your company’s workforce needs.

Medical exam

If you are sick or have a chronic health condition, no-exam life insurance may not be the answer for you. It is also worth looking into for those who need a life insurance policy quickly, but you will pay a premium for this option. Additionally, these policies can be twice the price of a fully underwritten policy. Therefore, it is important to weigh the costs against the benefits of no-exam life insurance before choosing a policy.

Securian Financial Group has more than 5,000 employees and oversees $78.6 billion in assets. The company’s financial strength rating with AM Best ranks it 30th among the top 200 U.S. life/health insurers. Size alone indicates a company’s financial strength. But size matters. A high financial strength rating indicates an insurer’s ability to meet its obligations to its policyholders.

Although Securitization does not offer guaranteed issue life insurance policies, the company has a no-exam program for healthy, young people and seniors. Those who qualify for this program can get term, indexed or universal life insurance policies. The company also offers a no-medical-exam policy called WriteFit. This policy combines term and universal life with chronic illness and long-term care coverage. If you can’t afford your payments, you can avoid the exam entirely through the WriteFit underwriting program.

A medical exam for Securian Life Insurance Company is often required as part of the underwriting process for life insurance policies.