Medical records are the primary source of evidence in a Sun Life Short Term Disability claim. However, records alone are not enough to win your claim. You may need to submit additional evidence if your medical records are insufficient. This further evidence can help you win your claim. Sun Life also considers whether your evidence is complete. You must provide additional documentation to prove your disability. If you cannot present additional medical evidence, you may request a hearing before Sun Life decides whether your case is valid.

Sun Life long term disability insurance

The strength of your claim for long-term disability benefits depends on the medical documentation you provide for your claim. If your primary doctor refuses to accept your claim. If you can’t communicate effectively with them, you may need to find another doctor who can. Filling out a medical file will be easier when you have another doctor to consult with. Here are some tips on how to fill out the claim form. You can also find out what documents are needed when you submit a claim for long-term disability benefits.

If you can’t work for months or years due to a serious illness, long-term disability insurance can help you get back on your feet. The PEF Membership Benefits Program may qualify you for long-term disability coverage. You can apply for this coverage if you are an active PEF member. The company uses the same formula for calculating benefits. To find out if you are eligible, read the information below and visit the PEF website.

You should understand the limitations of long-term disability insurance benefits. Often, the amount you get depends on the specific coverage you purchased. Some policies limit the amount of income you can receive from other sources, but many allow you to deduct from other sources of income. If you don’t have enough income, it may be worth shopping for a policy that does. The best way to get the best possible benefits is to speak with a professional insurance advisor. A consultant will be able to advise you based on the information you provide.

It provides an income stream to cover expenses such as rent, bills, and medical expenses after sun life short term disability benefits end.

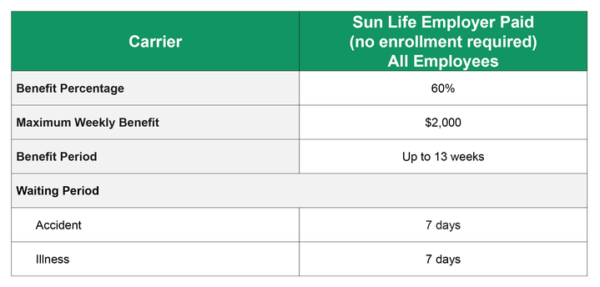

Sun life short term disability insurance

A member can claim benefits under sun life short term disability Insurance if they are unable to work due to a covered illness or injury. Benefits are payable up to 26 weeks after the onset of disability. Members should check their certificate for any other details. Benefits are not taxable. A member can claim online and save time by doing so before the claim deadline. Additionally, Sunlife Financial offers an online claim portal for members who need to lodge a claim. Generally, the claim form is the same for both long-term and short-term disability insurance. The claim must be accompanied by a medical certificate and a statement from the employer.

In case of denial of benefits, the consumer has 180 days to file an appeal. In most cases, the company will reject the claim within 45 days. Customers can request an extension of 45 days. However, Sunlife will not extend the deadline. Hence, it is advisable to hire an attorney to prepare the appeal before filing the suit. Moreover, it is important to consider legal fees and costs before filing a lawsuit.

Taxable income from long-term disability insurance

If you have long-term disability insurance through your employer, you may be surprised to learn that some benefits are taxable. The tax treatment of this type of insurance depends on the policy’s premium payment method and whether the employee paid pre-tax or post-tax dollars for the coverage. You will need to check with your tax advisor to find out how much of your benefits are taxable. Generally, you will be liable to pay tax on half of your benefits.

Many disability insurance policies are pre-tax. Buying a pre-tax plan through your employer will prevent you from paying FICA taxes and higher federal income tax payments (which can range from 10 to 37 percent of your earnings). Additionally, these types of policies will save you money on state income taxes. However, you should consider these options carefully if you need extra cash during a period of disability. Although your future benefits will be tax-free, you will have to pay tax on your pre-tax earnings.

A standard long-term disability insurance plan requires that payroll deduct your monthly premium after taxes. However, this type of insurance is often tax-deductible because the benefit is considered non-taxable income. However, a standard long-term disability insurance plan may come with additional benefits. Among them is a review of pre-existing conditions. The policy will cover the 90 days before the effective date of the policy, and if you have a pre-existing condition, you may be denied coverage.

For more insight on coverage, many individuals look at Sun Life short term disability reviews. which can provide a helpful perspective on the claims process and benefits experience.

Minimum benefit period

If you have a group life policy and you are disabled, a premium waiver allows you to continue paying your premiums even if you are not working. It also helps to continue coverage on your life insurance policy when you become disabled. However, the disability must occur before retirement or before the maximum age you are allowed to be on disability benefits. If you are not sure when you will become disabled, contact your company or plan administrator to find out the exact benefit period.

While determining your eligibility, you must read the plan terms and group policy. You must have been employed in an eligible class during the period before you became disabled. The period before the eligibility date begins is called the waiting period. For example, you must be actively employed by the county as a full-time employee for at least one year before you become disabled and disability benefits begin.

You will need to send regular updates on your condition to the insurance company to qualify for the maximum benefit amount. The longer the benefit period, the higher your premium will be. If you are a doctor or dentist, this insurance can protect your future income, even if you are permanently disabled. The minimum benefit period is five years. However, you can request an extension if you have a long-term disabling condition.

Medical conditions that qualify

If you are wondering what medical conditions qualify you for a short term disability policy from Sun Life. So there are several things you can do to strengthen your case. First, you should look at your group policy. This is an official document that forms a contract between you and the insurance company. It will determine whether your claim will be approved or denied based on the provisions within it. You can request a copy from your employer to make sure you understand your coverage. Be aware that group policies have specific exclusions for medical conditions, so you need to know that before you make your claim.

You should also be aware that Sun Life may contact your treating doctor to verify your claim. However, you should be aware that this approach will usually be ineffective, as Sun Life likes to poke holes in your claims. If you see one or two specialists, you can submit reports from both your primary doctor and your secondary physician. If your primary doctor does not cooperate, you will need to find another physician who can communicate with Sun Life.

Eligibility for a sun life short term disability claim depends on how these conditions affect your ability to perform job-related tasks and daily activities.

Maximum benefit period

When filing for a claim, applicants must submit the application and all supporting documents to the insurance company. Documents such as doctor’s notes, test results, and lab work must be submitted. The application form must be filled out online or submitted by mail or fax. If the insurer denies the claim, applicants must appeal the decision. The applicant must appeal within a certain time frame. In some cases, the company may accept the claim after an internal appeals process.

The maximum benefit period for Sunlife Short-Term Disability Policy depends on the amount of income the claimant earns every year. The maximum benefit period for a claimant is 52 weeks. However, a group plan may be better for an individual, especially if the claimant’s income is relatively stable. A person who is on the road to recovery may want to consider a combination of different policies.

LTD benefits are based on the schedule of benefits outlined in the employee’s employer’s group policy. Most group policies start with a standard “own occupation” term, which can be two, three or five years. Then, after the “own occupation” period ends, the benefits change to “any occupation” benefits. The maximum benefit period can vary depending on the policy, but benefits are generally higher than any other type of disability insurance.