The cost of life insurance varies depending on factors affecting the health and age of the individual. People who are young and healthy can enjoy lower rates, while those with high-risk hobbies or a family history of cancer can expect to pay higher rates. The policy you choose will ultimately determine how much coverage you will need. Then there is the question of duration. How long will you need your life insurance policy? What is your risk level?

Factors that affect life insurance cost

The premium you pay for a life insurance policy varies depending on various factors. These include coverage terms, payment structure, and investment options. Term life insurance, for example, has the lowest premium. A policyholder who is young and healthy can expect to pay a lower premium. However, those who smoke or engage in risky activities are considered to be at higher risk.

Certain businesses may also increase the cost of life insurance. Law enforcement, construction and war reporting are some of the occupations that increase the risk of death. These occupations may require more expensive life insurance than office workers. Additionally, combined policies can lead to discounts. However, not all businesses have the same level of risk.

A woman’s life expectancy is one of the most significant factors affecting the cost of life insurance. The younger she is, the lower her premium will be. Also, the premium for a younger male will be lower than a female’s. The average life expectancy of a woman is six to eight years longer than a man’s. Because of this, she will have more time to pay for her premium.

Several factors affect the monthly cost of life insurance. These include age, health, lifestyle, and policy type.

Type of policy

There are many life insurance policies, each with unique benefits. Some are permanent while others are temporary. The term life insurance is used to describe both. A permanent life insurance policy pays a lump sum to the life insurance company in the event of the death of the insured and also acts as a savings account. The savings element of a permanent life insurance policy increases with the dividends paid by the insurance company.

While choosing a life insurance policy, it is important to understand the specific terms and conditions of the policy. When many people buy the same type of policy. Different policies can then suit your needs and risk appetite. Different types of life insurance will carry different charges.

A term life insurance policy pays the death benefit only when the insured dies within a specified period. In contrast, a permanent life insurance policy protects your entire life, and can also build cash value over the entire term. Even if you die unexpectedly while holding a permanent life insurance policy, you will still receive the death benefit instead of premium payments over a longer period.

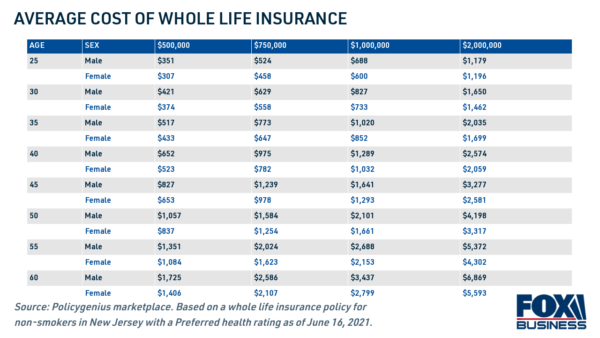

The cost of whole life insurance, on the other hand, is higher because it offers lifelong coverage and includes a savings component.

Age

Life insurance is expensive no matter how old you are, but there are some situations when it makes sense to buy a policy at an older age. For example, you may have a young family and need to cover funeral expenses, or you may want to consider a policy that covers more of your estate than you would need if you were to die today. If you are older and have paid off your mortgage, you may not have as many dependents and can save money by purchasing a shorter policy.

Age is a crucial factor affecting the average cost of life insurance per month. Younger individuals generally pay lower premiums because they are considered lower risk.

Smoking

For those who are considering buying a life insurance policy, smoking will increase the premium you pay. Statistics show that a smoker can see his annual premium increase by 94%. Additionally, the cost of a funeral can exceed $10,000. If you are looking for the lowest cost policy, consider comparing quotes from different insurance companies.

When choosing life insurance, consider your budget. If you are a smoker, a term policy will be the cheapest. If you die during the term, this type of policy will only pay the death benefit. The downside is that there is no return after the term is over. However, it is still the best option for smokers. The maximum death benefit will be less than a policy that is medically underwritten.

Smoking is a significant factor that affects the average cost for life insurance per month.

High blood pressure

Many factors affect the cost of life insurance, including high blood pressure. While your age, gender, and overall health can play a role in your premium, the insurance company also takes into account how long you’ve had high blood pressure. Younger applicants tend to have lower premiums than those with chronic high blood pressure. However, people with high blood pressure who have had the condition all their lives may be rejected for coverage. While most insurance companies will require you to disclose your blood pressure history, you should be aware that some may request medical records from the past 10 years.

If you have high blood pressure, you should be aware that this will increase your premium. Insurance companies base their rates on your blood pressure, but they will also consider your overall health and lifestyle. If you are willing to make the necessary lifestyle changes, it is possible to find a policy that offers you the right rate without high blood pressure. If you can maintain a healthy lifestyle and lower your blood pressure, you should qualify for a good life insurance policy.

Health status

In this report, the Institute of Medicine summarizes findings from more than 130 research articles that prove a causal relationship between health conditions and life insurance costs. The study design was observational and relied on statistical techniques to control for the effect of other potential predictors of health. In the United States, Medicare eligibility after age 65 reduces socioeconomic health disparities. In other countries, however, health disparities vary widely, and Medicare coverage is not a panacea for poor health.

There are several possible explanations for the association between health insurance coverage and the likelihood of being in fair or poor health. First, declining health can increase the demand for private health insurance, reduce a person’s eligibility for public insurance, or make a person uninsurable through job loss or reduced income. Second, it can explain the choice behavior of insurers. Third, cross-sectional associations between health insurance coverage and the risk of poor health are the result of an individual’s health status.

Health status is a critical factor influencing the cost of life insurance per month. Individuals in good health generally pay lower premiums because they pose a lower risk to insurers.