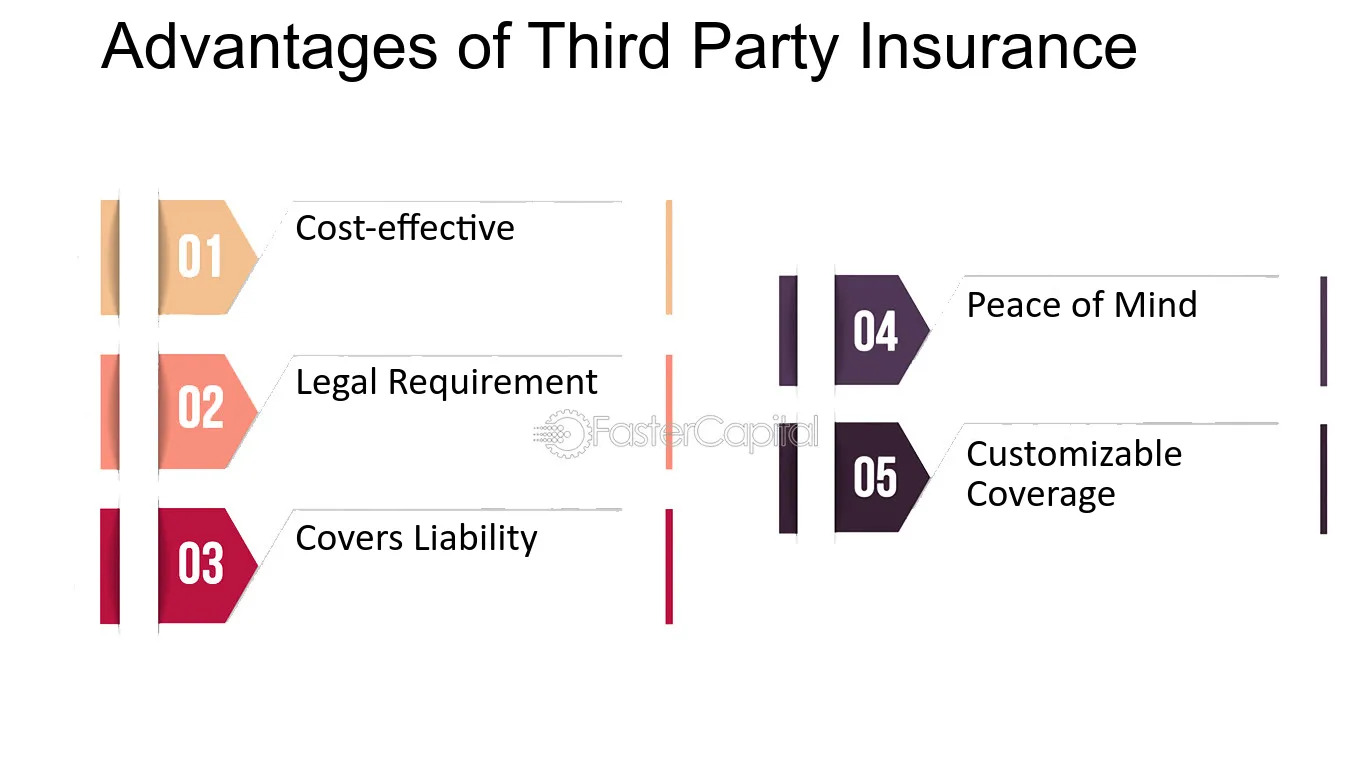

If you want to make sure you have the right coverage for your car. So you should consider buying third party insurance. This type of coverage will pay for damage to another person’s property and injuries to another person. This type of coverage is usually cheaper than first party insurance and offers fewer restrictions.

Covers damage to another person’s property or injuries to a third party

Liability coverage protects you against third party claims. It pays for third-party property damage as well as damage to your car. It also provides legal protection for you by ensuring your financial security when you face claims from a third party. Most states require you to have a liability insurance policy. So if you are at fault in an accident, you need coverage.

The process of claiming damages under third-party insurance involves the process of exchanging information and documents. Third-party claims are allowed up to the policy limit, and the responsible party pays the excess. In some cases, insurance companies may choose to pay medical bills or repair costs instead of filing a third-party claim.

While third-party insurance is important, there are many other types. Your liability insurance will not cover damages caused by your negligence or improper advice. You should consider professional liability insurance, also known as errors and omissions insurance. If you need liability insurance, try Thimble. It is easy and cheap to get. You can also get liability insurance on demand and apply for it online.

A home policy also includes liability coverage, but this type of policy is for a specific amount. A lower limit on liability coverage can leave you responsible for the balance. The hospital bill alone can run into thousands of dollars. With a third-party liability policy, you are from costly lawsuits that could ruin your finances.

If you are at fault in a collision, your insurance will cover medical bills, funeral expenses, and lost wages. This type of coverage also covers legal fees and defense costs. While it does not cover personal injuries, it does pay for medical bills and other expenses incurred by the other party. The minimum insurance requirement was in July 2018.

Is cheaper than first-party insurance

When searching for car insurance, you may be wondering what’s cheaper: third comprehensive insurance. While third-party insurance is the cheapest type of cover, it also offers the least protection. With this type of policy, you will only for the harm you cause to others and the injuries you cause to yourself. The benefits of each type of policy are below.

As with any type of insurance, a fully comprehensive policy is more expensive than first party insurance. Full comprehensive policies are expensive, as they cover more damages than third-party policies. High-risk drivers are more likely to claim than average. Third party insurance can prove to be cheaper in this situation. This should with a pinch of salt as the difference may not be so great as to be worth it.