If you ever thought you had an unclaimed life insurance policy. So you are not alone. It is the beneficiary’s responsibility to notify the insurance company of the death of a loved one. The unclaimed amount is not taxable and you will never have to pay a premium again. Here are the requirements for claiming. You can’t wait any longer to claim the money!

Unclaimed life insurance proceeds are not taxable

If your loved one has passed away, they may have left your life insurance policy. These benefits can be a nice amount. And you can use it for whatever you like. The only catch is that unclaimed life insurance proceeds are not taxable. For example, in Texas, if you die after 100, the money is considered due. Additionally, unclaimed life insurance proceeds are forfeited after three years. Therefore, these funds must be reported to the state as unclaimed property.

Generally, life insurance proceeds are not taxable as income. However, they may be subject to estate tax. This tax is levied on the amount given to your heirs. It will help to consider this when planning your estate and making financial plans. Fortunately, life insurance proceeds are not taxable like other assets in your estate. If you have an unclaimed policy, you may want to consider transferring it to a new owner. This person can become the policy beneficiary and must fill the appropriate assignment form.

Generally, if the beneficiary has died, the money will not be taxed. If the policy has a “death benefit”, the beneficiary may be liable for tax on the entire amount. This will be a problem for the estate. However, many people prefer to receive money in a lump sum. Alternatively, payments can be made in regular payments. While unclaimed life insurance proceeds are not taxable, the proceeds may still trigger estate taxes.

Beneficiaries are responsible for notifying insurers of a deceased loved one’s death

In most cases, the person designated as beneficiary can be an individual, charity, trust, or estate. The beneficiary can be almost anyone. However, it may be restricted by the state where the person lives or by the insurance company providing the benefits. Before naming someone as a beneficiary, be sure to learn about state laws regarding beneficiaries. In some states, the spouse of a deceased loved one must be listed as the primary beneficiary and receive at least half of the benefits. Others will allow a beneficiary without the spouse’s written consent.

If you do not know whether you are a beneficiary, contact the insurance company and inform them about your loved one’s life insurance policy. Life insurance companies use this information to determine who the beneficiaries of a deceased loved one are. Beneficiaries should know how to find a deceased loved one’s policy. You can also use the National Association of Insurance Commissioners’ life insurance policy locator service to see if a deceased loved one left instructions on how to contact the insurer.

Insurance companies often change names. If the deceased has left the policy issued by the previous company, the beneficiaries may not be aware of the change and therefore may not know where to find a new insurer. If a loved one died several years ago, the insurer will likely have updated the name of the company in question. The beneficiary should also check with the deceased’s former employer whether the policy has group life coverage.

Prompt notification ensures timely processing of the claim. If policy details are unknown, check personal documents or search for unclaimed life insurance online.

Policyholders can claim within 30 days of approval

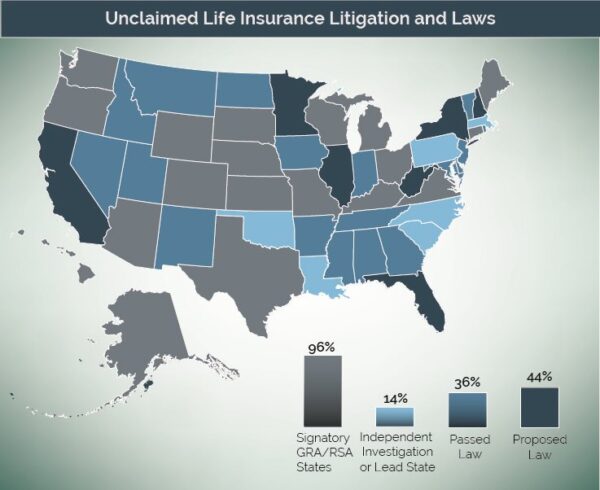

New York law goes further than other states in addressing the problem of unclaimed life insurance policies by requiring the Department of Financial Services to create a lost policy finder program. The program allows citizens to request information about a lost policy by contacting an insurer online or by toll-free phone. Once an unclaimed life insurance policy is identified, it has 30 days to file a claim. Other states, including Kentucky, Maryland, Alabama, and Vermont, have also adopted model ULIBA laws.

Consulting with a financial advisor or attorney can provide further guidance on navigating the Indiana unclaimed life insurance claims process.

Requirements for making a claim

If you are a beneficiary of a life insurance policy and want to claim your money, you should be aware of the requirements for making a no-claims life insurance claim. Unclaimed life insurance benefits are not the property of the insurance company. Those who fail to collect the revenue have to surrender it to the state authorities. Because of this, many unclaimed life insurance beneficiaries assume that their insurance companies will find them.

According to a Consumer Reports study, the average unclaimed life insurance benefit is about $2,000. The state of Texas has an agency that works to recover unclaimed property. The Comptroller’s Office’s Unclaimed Property Division has identified more than $178 million in insurance benefits owed to Texans. It has returned more than $41 million to those entitled to it. In 2016, alone, these two agencies recovered more than $3 billion in unclaimed life insurance benefits.

The process of recovering these funds is not easy. First, the insurance company needs to locate the deceased person’s death certificate. They should also find the insured person’s social security number. Once the unclaimed benefit is received, the insurance company is required to pay the beneficiary. In most cases, this payment will be made within thirty days of the policyholder’s death. However, some policies state that claims for unclaimed life insurance must be made within a certain time.

There are several ways to find unclaimed life insurance benefits. You can start by looking at bank statements. The canceled check you receive may contain information about past premium payments. You can also inquire from the insurance company that the deceased has purchased the policy.

If any details are unknown, check personal records or use online resources for unclaimed life insurance michigan.