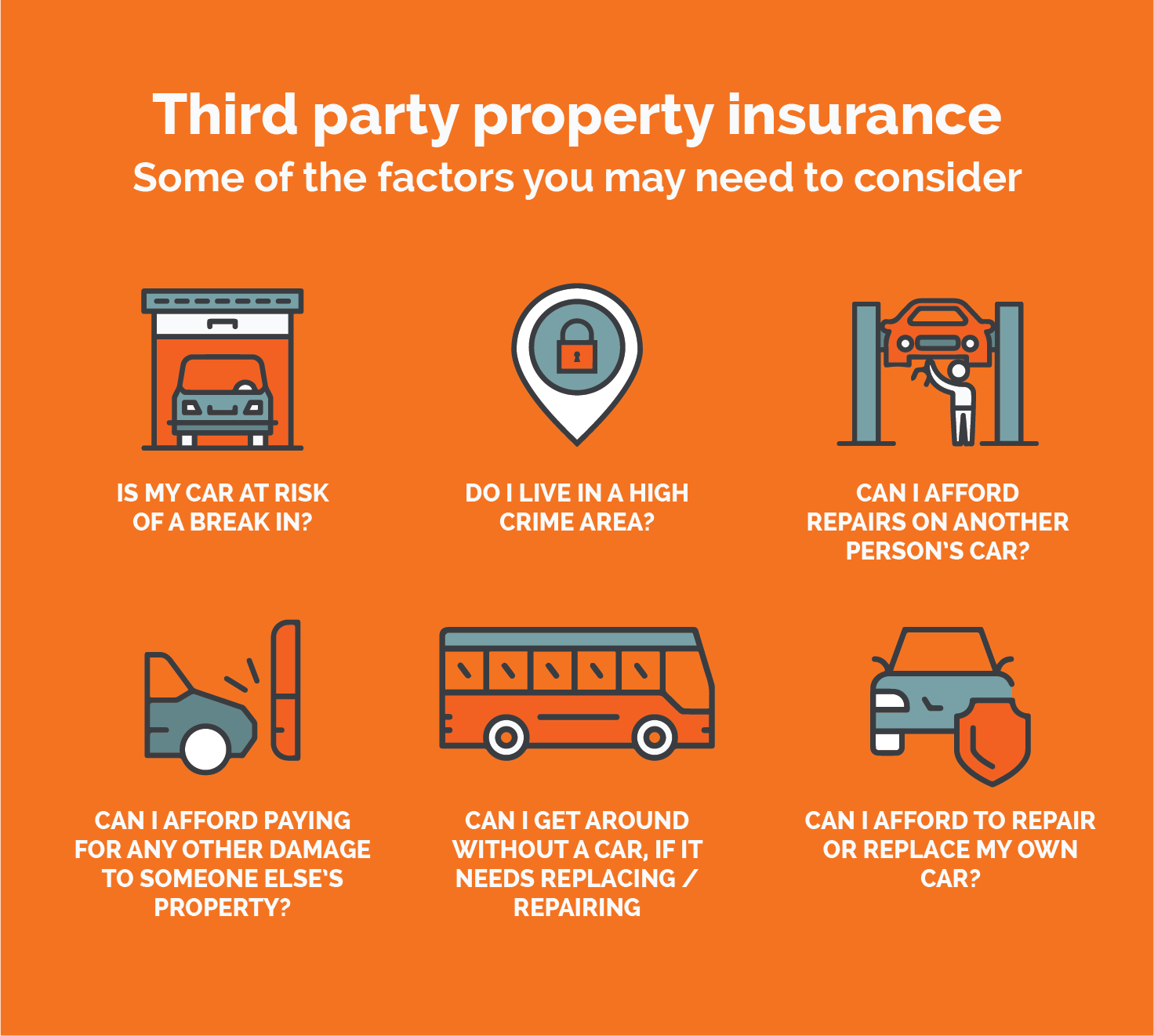

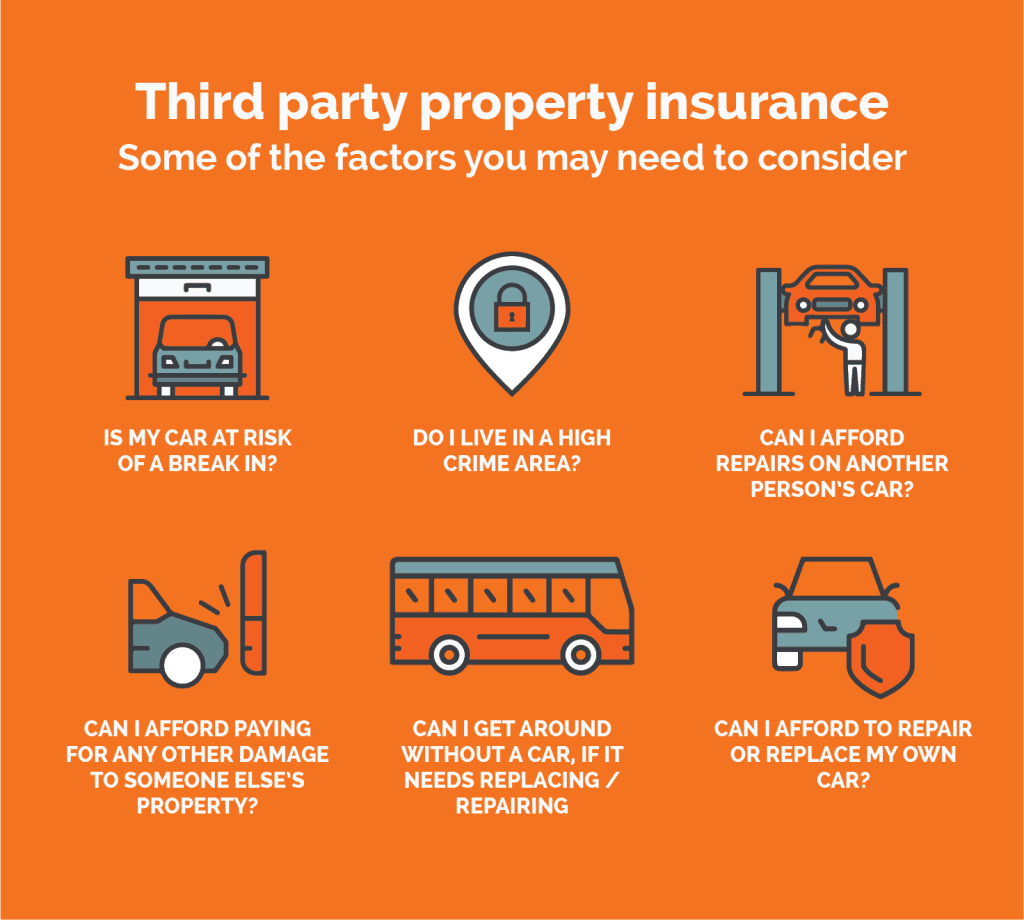

What is Coverage for third-party property damage? Find out about the Claims process, Exclusions, and Common causes of third-party property damage. If you have been in a car accident, follow these tips to file a claim. You can also find out more about the insurance company’s customer service. Choosing the right insurance coverage is critical to your car insurance policy. Below are some tips to help you decide which policy will give you the best coverage.

Coverage options for third-party property damage

Property damage coverage is a type of insurance that pays for repairs to another person’s property after a collision. Some companies offer multiple levels of coverage, depending on the property damage involved. The different levels of coverage can include damage to trees, fences, landscaping, and more. The limits vary, but you can expect the minimum amount of coverage to be $25,000/$50,000. For more information on property damage insurance, contact an agent today.

Homeowners insurance is an excellent resource for first-party losses. However, you should also consider third-party property damage coverage as well. In case of third-party damage, this includes your insurance company and the third party. This person may be a neighbor, a non-family member, or someone you don’t know. Homeowner’s insurance if your property is damaged by an uninsured person. Then you should consider purchasing third-party property damage coverage.

For third-party property damage coverage, check the guidelines of IRDAI. It’s best to choose third-party liability insurance if your vehicle is more than five years old. However, it’s worth mentioning that third-party property damage coverage is not limited to this limit. The IRDAI has guidelines that say you should limit property damage coverage to Rs 7.5 lakh for older vehicles. You can choose the level of coverage according to your needs and budget.

Having third-party property damage insurance is necessary for you to protect your wallet and other assets. It can cover damages to mailboxes and garages, among other things. Depending on the insurance company, it may not be necessary to purchase a high-limit property damage policy, but most experts recommend at least $50,000. In either case, third-party property damage insurance is designed. Other party benefits, so carrying high-limit coverage is a good idea.

Claims process

The claims process for third-party property damage is more involved than that for other types of claims. However, it is still possible to receive compensation for property damage. Oftentimes, the insurance companies you qualify for. If your claim is unreasonable, it will pay less. Third-party damage claims have a three-year statute of limitations and negligence must be proven to bring a claim in court. A claimant must prove that the other party was negligent to receive compensation for their damage. It is imperative to be prepared for this lengthy process and have as much documentation as possible.

Sometimes, a motorist will fail to stop at a stop sign and crash into your car, or it may be as simple as an inattentive neighbor who breaks a window. You can seek compensation for both your injuries and the damage to your vehicle through third-party insurance. Likewise, a homeowner’s insurance policy will help you if you are injured while trimming a tree in their backyard and causing damage to their house.

In most cases, the claims process for third-party property damage starts with notification of the loss. The insurance company appoints a claims adjuster to investigate the claim and decide if the fault is involved in the accident. In some cases, an adjuster will contact the insurance company of the at-fault driver to determine the amount of compensation that is due. Depending on the circumstances of your claim, the adjuster will either agree to pay your full claim amount or deny it altogether. If you are not satisfied with the decision made by the adjuster, you can negotiate with the adjuster or take your case to court.

Exclusions

An important step toward ensuring coverage for damages caused by your actions is to understand the language of your insurance policy. The exclusions in your policy may have a broad or narrow interpretation, depending on the type of damage involved. In British Columbia, for example, a policy may exclude damage caused by your product. An exclusion may exclude damage caused by your work, but it does not necessarily exclude property damage caused by your actions.

There are two main types of exclusions for third-party property damage. The first exclusion applies to the entire project, including the building, or work, and the second one applies to subcontractors who are performing the work on your behalf.

Unlike a general contractor, this activity is a component of a larger project. Damage to third parties caused by this subcontractor will be classified as property damage. Another example of a CGL exclusion is the construction industry. It applies to certain construction projects that include asbestos-containing materials. A contractor, for example, might be inadmissible to claim if he did not use the proper materials. Defective workmanship, however, falls within the definition of an “occurrence” for a policy’s exclusions. The insurance company will likely try to avoid paying for the deficient work by denying coverage.

A third version of this exclusion applies to property damage arising from a third party’s product. The exclusion also applies to any property damage caused by a third-party subcontractor. In this case, the insurer would have to pay for the damage caused to the other property. Ultimately, the policy limits its coverage for property damage to third-party products and services. You should consider this carefully when assessing your policy.

Another type of exclusion pertains to property. Some policies exclude damage caused by mold or “fungus.” The earth’s freezing and movement exclusions exclude earth-damaged property. However, in many cases, there is a type of loss. Excluded under more than one provision. For example, mold can exclude earth movement and water damage. The same is true for other types of damage, such as civil commotion, riots, or war.

Common causes of third-party property damage

Some courts have rejected the concept of third-party property damage as a business risk. In Federated v. Grapevine, the court rejected the insurer’s argument that the homebuilder was liable for its defective workmanship, even though the home was a third-party property. But a few other courts have discarded the notion of third-party business risk. In other cases, such as First Texas Homes, Inc. v. Mid-Continent Casualty Co., the court rejected the insurer’s argument.

In many cases, property damage is an important aspect of a personal injury claim, even if it is a simple car accident. If you own a property and a third party has damaged it, you can file a claim for the costs of repairing the property. It is critical to document the damage and record video from multiple angles. If possible, find pictures of the property before the incident occurred and document the damage.