Liability coverage is the foundation of car insurance. In addition to this, full coverage car insurance also covers the costs of damage and injuries you cause to other people, as well as damages to your car. You may also choose to add collision and comprehensive coverage to your policy. These additional types of insurance cover the costs of medical treatment for at-fault drivers and uninsured drivers. Listed below are several reasons why full coverage car insurance is so important.

Liability coverage is the foundation of car insurance

While it may cost more to insure your car in full, there are many advantages to having a comprehensive policy. For starters, you’ll have more coverage in case of an accident. Liability coverage, which covers accidents or damages caused by you, is sufficient for most people. However, you can opt to increase this coverage if you wish. Full coverage car insurance protects your most valuable assets, so you should not skimp on it.

When it comes to car insurance, liability coverage is the most fundamental. This type of coverage pays for the medical costs of others if you are at fault in a crash. It also covers the damage that your vehicle causes to another person’s property. Liability coverage is required in almost every state. However, this type of insurance never covers your expenses, so you’ll need to get additional coverage.

Full coverage car insurance offers the highest level of protection, which is also the most expensive type of policy. The comprehensive car insurance coverage covers both physical injuries and damages caused by the other driver. Comprehensive coverage pays for other people’s medical bills and other expenses as a result of an accident. In addition, full coverage policies pay for repairs and replacement of your vehicle in the event of an accident. You can also choose from a variety of other types of insurance to protect yourself against unexpected expenses.

Full coverage car insurance usually includes collision and comprehensive coverage as well as rental reimbursement. Other benefits include emergency roadside assistance and rental reimbursement. Comprehensive coverage can protect a high-value vehicle. Although the minimum coverage paid is affordable, it can cost you thousands of dollars if it is involved in an accident with multiple vehicles. It is important to understand what each type of insurance covers and how it works.

In addition to liability coverage, full coverage car insurance also includes personal injury protection (PIP). PIP covers bodily injury caused by another driver. Liability insurance does not cover medical expenses incurred by you or your passengers. If you cause an accident, personal injury protection is an option, but it is not required. Personal injury protection (PIP) will pay for your passenger’s medical expenses and may cover lost wages or household services. In some states, personal injury protection is mandatory.

Comprehensive and collision coverage are optional

If you have paid off your car. But still haven’t found a policy for it, then you should consider buying comprehensive and collision coverage. Getting this type of coverage may help you save money, but make sure you can afford the deductible. You should also check out any discounts you can get to lower the cost of your coverage. Comprehensive and collision coverage is optional with full coverage car insurance.

While collision and comprehensive coverage are optional with full-coverage car insurance, some lenders do require them. These are the policies that will cover damages that are not the result of a collision, such as damage caused by falling or airborne objects. This type of coverage is a great option if you own a classic car. This type of coverage can be customized for your particular needs. It will also be helpful if you rent or lease your car.

When you purchase collision and comprehensive coverage. Then you should also add the rental reimbursement. Both types of coverage will pay for the cost of renting a car while your car is being repaired. Comprehensive coverage is mandatory in many states, so it’s important to get it if you plan to drive on public roads or lease a vehicle. Comprehensive and collision coverage are the most common types of car insurance, and the cost depends on which you choose. If you’re unsure of which type of coverage is best for your needs, talk to a broker or agent. They can help you compare policies, negotiate discounts, and help you choose the best option.

Once your car loan is paid off, you can choose to drop collision and comprehensive coverage. Your car’s value will likely dictate whether you need to purchase collision and comprehensive coverage. If it’s not worth much, you might be better off dropping them altogether. Choosing to keep or drop this coverage depends on your finances and the model of your car. And if you’re worried about being a risk to other drivers, you can always opt for uninsured motorist property damage coverage.

Cost of full coverage car insurance

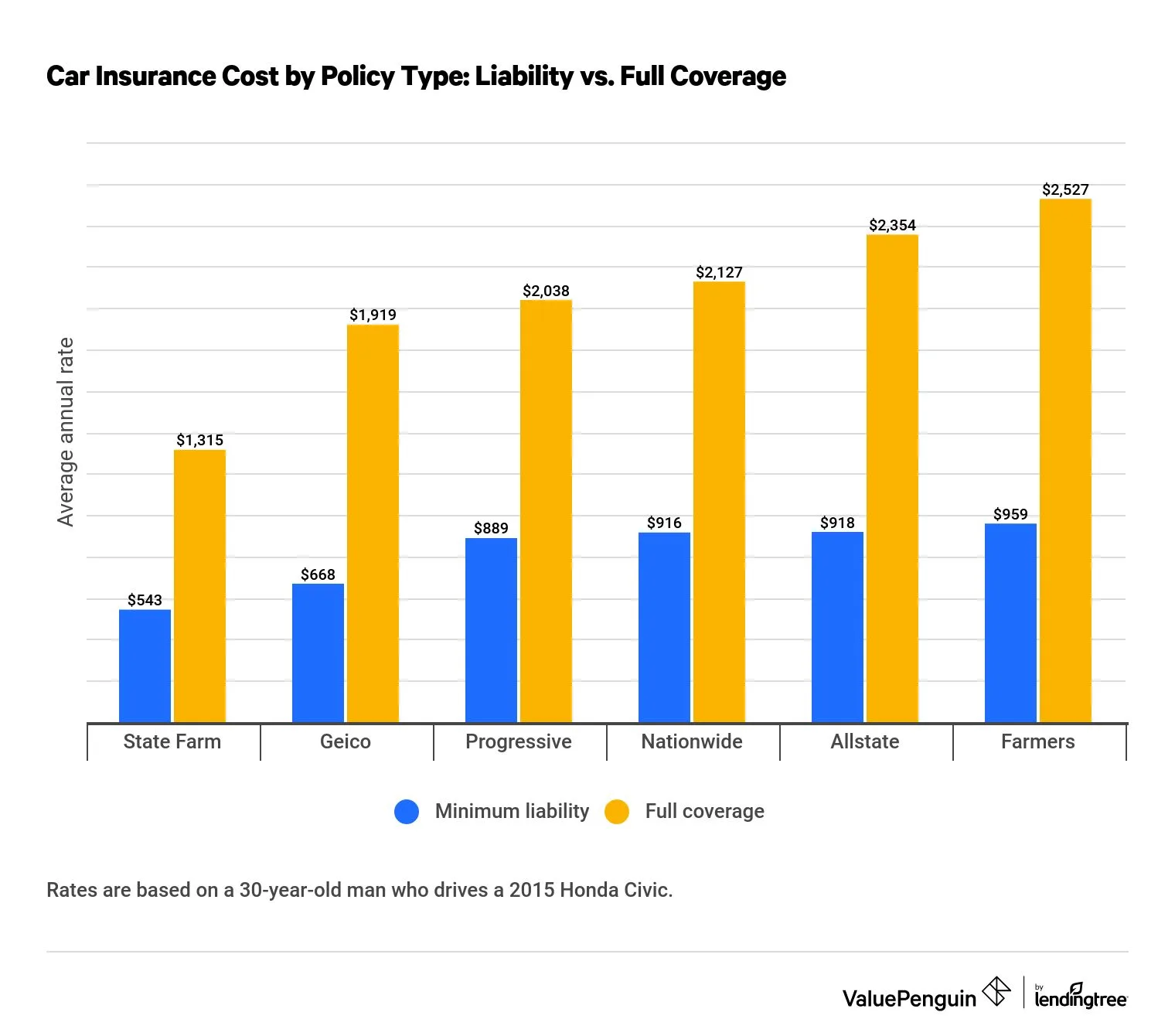

Auto insurance companies in your state may offer different discounts and perks. Talk to your insurance agent to see what discounts they can offer you. To find the best rates, get quotes from multiple insurance companies. Each auto insurer has a different rate for full coverage, so the same level of coverage can cost you drastically different amounts from one provider to another. You can then compare these quotes to see which one offers you the best value. For example, the same level of coverage for a compact car could cost more than twice as much as the same coverage from a luxury SUV.

Full coverage is important because it protects you in the event of a car crash. A policy with adequate bodily injury coverage is the best choice to avoid financial ruin. Some companies offer additional coverage. Which is suitable for certain types of vehicles. You must also know what your state’s minimum requirements are for auto insurance. Some states require you to carry a minimum amount of coverage, while others don’t. This is a common mistake.

Full coverage car insurance is more expensive than liability-only policies, but it pays for repairs from at-fault collisions, theft, and weather damage. Before you shop for full coverage car insurance, consider which companies are the most reliable in your state. While GEICO is the cheapest car insurance nationwide, you can still save money if you compare prices with companies in your state. You may want to consider switching companies after you’ve reached age 25.

In the US, full coverage car insurance can cost about $1,652 a year, or around $137 per month. But the cost of insurance depends on the type of car and driver you’re driving and other factors, including age, gender, and credit history. The best way to find the lowest rate is to get multiple quotes from insurance companies. The average cost of full coverage car insurance is $137 per month, and you can save as much as $539 a year by getting an insurance policy from Geico.

Ways to find affordable full coverage car insurance

One of the best ways to find cheap full-coverage car insurance is to shop around and compare rates from different carriers. Some of these comparison sites can help you save as much as 47%. It is a good idea to compare quotes from multiple carriers so you can choose the lowest rate. However, comparing rates can be difficult if you’re not familiar with the ins and outs of auto insurance. In this article, we’ll talk about the best ways to find cheap full-coverage car insurance.

In the United States, full coverage of car insurance may be required by law for financed vehicles. This type of insurance pays for expenses incurred by other parties. In the case of an accident, if you’re at fault, your insurance provider will pay the expenses of a poor pedestrian. Additionally, many insurance companies offer discounts based on group membership, driving history, or how many policies you have. If you are still skeptical about the benefits of full coverage car insurance. So check out WalletHub’s guide to car insurance discounts.

Keeping your driving record clean is a great way to keep your premiums low. However, cheap insurance does not mean it is the best policy. But the policy meets your needs. It doesn’t hurt to check your driving record first to make sure. Some insurance companies charge higher rates for cars with a bad driving history than for vehicles with a clean record. If your car has many safety features and low deductibles, the cost will be lower.

Getting full coverage auto insurance is important if you own a car worth more than the value of the car you’re insuring. Full coverage is the best option if you have a loan or lease. Although not required by law, it is generally recommended if you have taken out a car loan. This is especially true if you have a car that is worth a lot of money.