Root auto insurance is an app-based insurance company. It offers discounts based on your driving history and roadside assistance. However, it does not cover high-risk drivers. So, is Root the right choice for you? Let’s discuss this. We’ll also look at what you can expect if you purchase a Root auto insurance policy. The following are some things to know about Root auto insurance. Continue reading to learn more about this app-based insurance company.

Root auto insurance is app-based

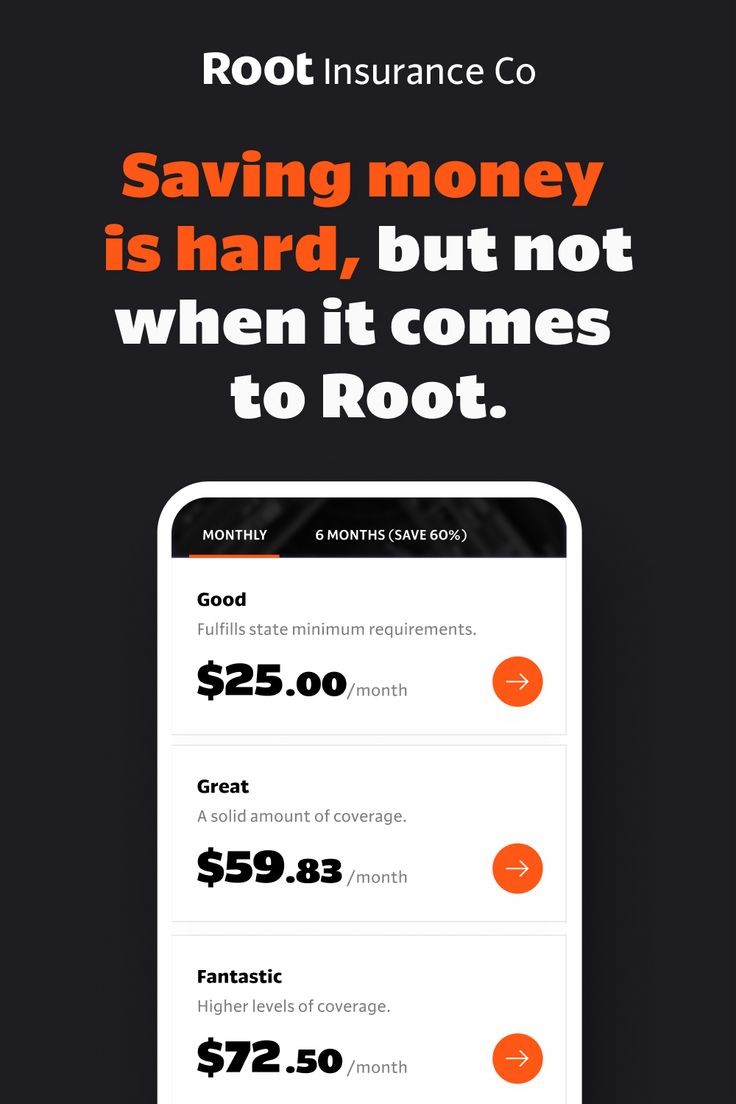

If you’re looking for inexpensive vehicle insurance, you’ve heard of Root, an app-based service. The concept behind Root’s insurance policy is simple: it’s an insurance policy that’s tailored to the individual. The company’s price structure is based on several variables, including credit score, driving record, and driving tendencies. However, some drivers are not eligible for coverage with Routes due to those factors. The good news is that it’s possible to get lower rates if you have a good driving history and don’t drive much.

For a quote, customers must answer a few simple questions on the Root website, such as their name, address, marital status, and the types of cars they’d like to insure. Once the application is completed, the customer can take a “Test Drive” to receive a personalized quote for their insurance. This process takes about two to three weeks, and the company will contact the potential customer to confirm their insurance.

Route’s system tracks their driving habits to ensure their customers are getting the best possible rates. This helps determine the rates, which can be significantly lower if a driver maintains good driving habits. Although the prices vary from driver to driver, drivers can expect to pay as low as $707 for full coverage. That’s more than 50% lower than the national average premium for the same insurance. The app also offers roadside assistance, which pays for the costs of repairing a car or getting to a mechanic.

The Root website is easy to use and offers a blog and FAQ section to help customers understand their policies. Root also offers an online quote and a smartphone Test Drive. Lastly, Root’s app is available for iOS and some Android devices, and has a 4.7 rating on Apple’s App Store and 3.7 on Google Play. And if you’re wondering if Root is the best app for you, check out their website for an overview of the features.

It offers discounts based on driving record – Root Auto Insurance

If you’re looking for auto insurance with the best possible price, consider Root. This company prices policies based on your driving habits and history, instead of a traditional premium based on your age, gender, or location. As a result, it’s more accurate at portraying your driving habits. Moreover, you’ll be able to track your insurance costs via their mobile app.

Download the Root app and create an account to get going. You can even add more drivers without taking a test drive. You’ll receive a scorecard that shows you how safe or unsafe you are. Depending on your demographics, Root may even offer discounts based on driving history. This is important if you’re a safe driver and don’t drive recklessly. Additionally, driving a car without insurance is a bad idea.

While many companies have a good reputation for customer service, Root’s may not be the best choice for everyone. There are numerous alternative possibilities, even if this firm provides cleaner drivers with reduced charges. You can even choose to get coverage for high-risk drivers if your driving history doesn’t have too many tickets and accidents. As a result, it’s difficult to compare Root with other insurers based on their rates alone.

If you have a good driving history and drive safely, you can save up to $900 on your annual premium. To find the best rate for your unique situation, you can consult the website of Root’s online insurance team. You can also check out their referral bonus program. Referring a friend to Root could earn you up to $1,000. Although the company is not available yet, it’s coming to Wisconsin, but it’s not available for policy purchases yet.

Another important feature of Root’s online auto insurance is its automated renewal. Depending on your driving history and other factors, you may have to renew your policy every six months. Unlike many other insurance companies, Root auto insurance automatically renews, so you don’t have to worry about making monthly payments. However, you can make your monthly payment flexible, with a five-day window to pay the first month, and you can easily cancel your policy without a hassle. In addition, the premium changes based on various factors.

It offers roadside assistance

Roadside help is one of the key advantages of Root auto insurance for its clients. This assistance is available at no additional cost, and the company pays for it through a paper check or electronic payment. In case of an accident, Root does not cover the cost of the tow truck, but it will reimburse the driver with a $100 flat fee. The service is easy to use, and customers can use an app to submit claims.

Root auto insurance may be a wise decision for people with a history of reckless driving. Because it considers your driving record and driving history when calculating your rates, you can enjoy better rates with the company. While the company’s policies are not as affordable as those of some traditional car insurance companies, those who have a clean driving record report saving with Root. Root auto insurance does not offer gap insurance, which protects against the possibility that you will receive a claim check for less than the balance on your loan.

Customers can customize their insurance policy online and can choose the plan that fits their budget and driving history. Root also reimburses customers for Lyft credits, rental car insurance, and roadside assistance. The Root auto insurance app allows policyholders to select coverage amounts and set deductible limits. Root does not offer discounts for low mileage or good driving history, so it is important to know your coverage requirements. However, many policies are free so you can choose which plan works best for you.

Roadside assistance is a convenient benefit that comes with most auto insurance policies. Roadside assistance from Root includes emergency roadside help for up to three times per vehicle in the first six months of the policy. Unlike AAA, this service does not require a membership fee. Root auto insurance is affordable and offers great coverage. This is a great choice for those who want to save money while driving. But make sure you read the fine print.

It doesn’t cover high-risk drivers

There are a few reasons why you should not choose Root auto insurance if you are a high-risk driver. While it’s not a bad idea to check your driving record before purchasing any insurance, it is also a great way to avoid paying more for your coverage than you have to. While many companies won’t cover high-risk drivers, Root won’t. They base their rates on your driving record, which is weighted almost as heavily as your test drive period.

First, consumers should be wary of new companies. Check reviews of other companies before deciding on a provider. The root is not rated by any major rating service. It is large enough to accommodate many comparisons. Additionally, the company’s funding is higher than the national average. Likewise, consumers should be careful when choosing a high-risk auto insurance provider.

Second, you should not get the wrong impression about Root’s policies. While they do offer low-risk drivers lower rates, they don’t cover high-risk drivers. Although Root claims to save you up to 50% compared to other insurance companies, they don’t offer many additional discounts. The root is not available in all states. Hawaii, Alaska, and the District of Columbia are some of the states where they don’t operate.

Finally, root auto insurance does not cover high-risk drivers. If you fail your driving test or have a bad driving history you will be disqualified. The company eliminates high-risk drivers by comparing your driving history to demographics and averages. Ultimately, this is not fair. However, if you are a good driver, root car insurance may be worth a try.

When the route does not cover high-risk drivers. They provide coverage for different types of vehicles. However, it’s important to note that these insurance plans can be more expensive than traditional car insurance companies, but drivers with good credit or low-mileage reports can save money by switching routes. Additionally, Root does not offer gap insurance, which is essential for high-risk drivers. Therefore, high-risk drivers should look for a separate auto insurance plan.