You may have a few questions when shopping around for cheap affordable car insurance. These questions should be answered if you want to get the best coverage at the lowest possible cost. Here are some important facts to keep in mind:

GEICO – Cheap Affordable Car Insurance

In addition to offering GEICO cheap affordable car insurance, GEICO offers a variety of other products. Most insurers base their monthly premium rates on the financial strength of a consumer’s credit account. However, there are ways to reduce your GEICO insurance premiums by raising your credit score. For example, making payments on time and avoiding liens are effective ways to improve your credit score. Your insurance company gives you a discount if you are a member of a credit union or financial planning association.

GEICO’s prices are lower than those of many major insurers. The average monthly premium with GEICO is $513 per year. The company also offers elective discounts, such as a discount for driving defensively or taking a driver’s education course. Furthermore, you can get a discount if you’re a member of a professional organization, such as the American Society of Safety Engineers (SAE).

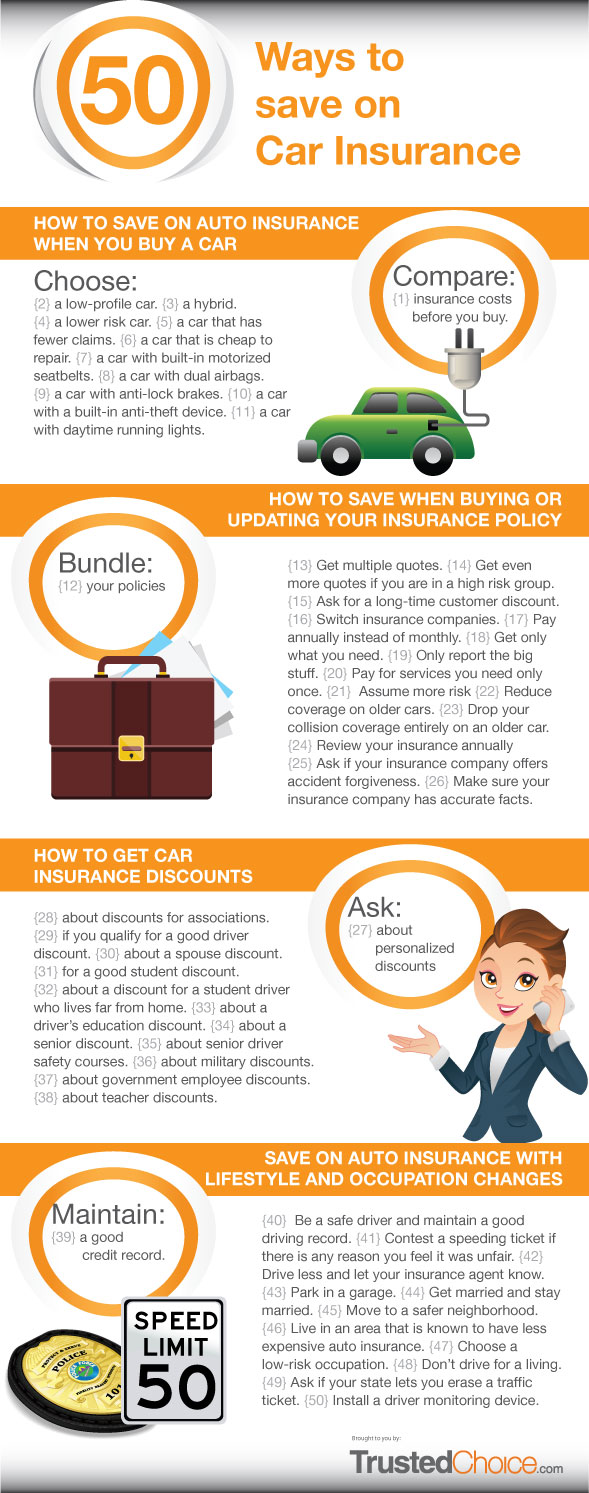

While you’re at it, shop around for GEICO’s cheap car insurance. A good way to find a great deal is to use a comparison website. Compare quotes from several different companies, and don’t forget to consider discounts and telematics. GEICO’s low rates are the best option if you have a clean driving record. Additionally, you’ll receive discounts for installing an anti-theft system and using a seatbelt. Insurify’s quote comparison tool is convenient. GEICO’s cheap insurance rates can get higher if you’ve had a traffic violation, but they’re still affordable.

Another way to reduce your rates is to bundle two insurance policies with one company. Homeowners and auto insurance can be bundled together. The latter can save you about $12 per month. How much do you drive each year when looking for cheap car insurance? Consider what your credit score is. Having a low score or high zip code can make the difference between getting cheap car insurance and paying too much.

State Farm – Cheap Affordable Car Insurance

Aside from having affordable car insurance, State Farm has many discounts available for its customers. If you’re not sure how to apply for a discount, the best way to get the lowest rate possible is to stack multiple discounts. These discounts include good student, being accident-free, taking a defensive driving course, or having driver training. Aside from these, you may also qualify for a discount if you have a good student record or own a new vehicle with low mileage.

Most states require that drivers carry liability coverage. This covers both bodily injury and property damage. Another coverage option, collision coverage, protects you in the event of an accident with another vehicle. Collision coverage pays for repairs to your car and medical expenses if you are the other party in a crash. You’ll also receive protection if you’re involved in an accident with an uninsured or underinsured motorist. These policies are generally required by law in many states.

As far as prices. State Farm car insurance is affordable for people with good credit. The average cost of full coverage from this company is about $1700 per year. You will get a discount if you pay the insurance in advance. Most drivers choose to pay for monthly coverage. However, State Farm car insurance can cost more if you are a high-risk driver. You may want to consider a different car insurance company.

State Farm offers several flexible payment options. It’s possible to buy a policy on a six-month or twelve-month basis. Twelve-month plans tend to be cheaper for many drivers because they allow you to negotiate a lower premium. For example, a typical $1450 policy might require a payment of $121 a month. You’ll likely put a down payment when you enroll, and make payments every 30 days.

Auto-Owners

If you’re shopping for a cheap car insurance policy, Auto-Owners Insurance may be a good option for you. The company offers a variety of discounts for drivers, including good credit, green, and paperless billing. If you’re looking for a good student discount, you may also qualify for a multi-car or good student discount. For more information, visit Auto-Owners.com or call 800-447-7372.

Young drivers may be surprised to learn that there are a variety of discounts to choose from with Auto-Owners Insurance. Good grades and a good driving record can save you a considerable amount of money. There’s even a student away-at-school discount, which can be especially helpful for students who’re still in college. You can also take advantage of additional discounts, such as those for teenagers who’re enrolled in college and don’t drive a vehicle.

Although Auto-Owners has been around for nearly four decades, it’s worth noting that its financial strength has consistently received top ratings from AM Best. As a bonus, you can choose from thirteen different discounts. Auto-Owners’ car insurance quotes are available only through agents. While their customer service is great, you may have to deal with an agent for some issues. Luckily, there’s also a chat option online that will guide you through the process of securing the best possible insurance coverage.

Auto-Owners’ cheap affordable car insurance offers great discounts for drivers of all profiles. From young drivers to those with past traffic violations, this company’s prices and coverage are great for all kinds of drivers. And you can use the free Auto-Owners car insurance comparison tool to determine if it’s right for you. You’ll never regret a decision to purchase an auto insurance policy from this company!

Progressive

If you’re looking for cheap car insurance, look no further than Progressive. This company has the lowest rates in the industry and doesn’t skimp on coverage. You may get a discount if you own more than one car or have multiple policies with them. Other discounts include homeowner’s insurance and multi-policy discounts. E-signatures can also save you money. If you’re a student, consider enrolling in one of its student discounts.

While Progressive ranks poorly in our survey, many drivers find its rates competitive. Teen drivers with a DUI will find it more affordable than most other providers. However, rates will vary by zip code, driving history, and preferences, including which kinds of coverage you need. And keep in mind that your age and driving record can affect your rates as well. The good news is that Progressive offers free cancellation no questions asked. If you have any questions or concerns, don’t hesitate to contact their customer service department.

You can buy insurance from Progressive online, through independent agents, or by phone. Progressive offers different types of discounts, so you’ll want to compare quotes for the best savings. However, remember that certain discounts are available only if you buy your policy directly from the company. Be sure to read the details of any potential discount before you buy. Remember, these savings are based on a national average over twelve months. Savings will vary by state and situation. For example, a DUI may cost less than a speeding ticket, but an accident could cost upwards of $1,000.

Another way to gauge Progressive’s affordability is to look at the company’s rating. Consumer Affairs and Moody’s rate the company favorably. But not as tall as the other two. However, the company has increased its market share and is attracting new customers. With so many outreach methods and excellent customer service, it’s hard to say which company is the best. If you’re in the market for cheap car insurance, look no further than Progressive.

Erie Insurance

If you’re looking for cheap car insurance, consider Erie Insurance. With Erie, you can enjoy many perks at a low cost, including a free personal belongings policy. Erie pays up to $350 for your personal belongings if you report a claim within seven days of buying your car. Airy new and used cars as well as trailers and temporary Replacement also offers policies for both.

For young drivers, Erie offers several discounts for safety equipment such as anti-lock brakes and anti-theft devices. Young unmarried drivers can also qualify for the youthful driver discount. Additionally, you can receive discounts for driving with a clean driving record. Erie also offers a lifetime policy discount for people who have been with the company for a decade or more. Listed below are some of the discounts Erie offers.

Senior drivers have lower rates with Erie. Generally, seniors pay higher rates than younger drivers. Because they are considered high-risk by insurance companies. Senior drivers may also have slower reaction times than a decade ago. This results in more accidents and insurance claims. Choosing the right coverage for your needs and your budget is important. This way, you can save money without sacrificing your coverage.

After a DUI conviction, Erie Insurance rates jump up dramatically. If you’re a good driver, your monthly premium can be as low as $52. Despite its steep price, Erie’s rates remain among the best in the industry. Aside from a low monthly rate, Erie also offers a deductible discount program that lowers your monthly payments. It is easy to get quotes online, and Erie’s customer service is second to none.