WalletHub’s in-depth research into the average cost of car insurance provides invaluable insight into this financial pillar. As individuals try to align their budgets with their insurance costs. So diving into WalletHub’s research reveals important information. Read the average price of car insurance to know more about it, you can know the exact information.

Unveiling WalletHub’s Insights: A Window into Average Car Insurance Costs

WalletHub’s research on the average car insurance cost per month transcends mere numbers. It serves as a compass guiding individuals through the intricate landscape of insurance expenses. By understanding where their insurance premiums stand in relation to the national average, individuals can gauge competitiveness, identify potential areas for savings, and make financially sound choices.

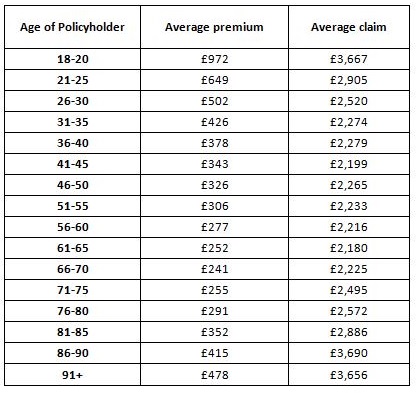

Age and Beyond: Navigating Car Insurance Rates by Age Chart

One of the attractive dimensions of car insurance lies in its relationship with age. The car insurance rates by age chart is a wealth of insight. which shows trends influencing premiums at different stages of life. Younger drivers are more susceptible to higher rates than normal face while a good record often results in higher premiums for older drivers.

Empowering Consumers: The Car Insurance Cost Calculator

The car insurance cost calculator is a potent tool for those seeking to demystify their insurance expenses. By factoring in variables age, location, driving history coverage preferences, this calculator provides an estimate of potential insurance costs. It bridges the gap between theoretical concepts and actionable financial planning, enabling individuals to make informed decisions.

Unraveling Factors: The Complexities of Average Car Insurance Costs

The nuances that contribute to average car insurance costs are multifaceted:

- Geographical Influence: Your location wields substantial influence. States differ in traffic density, accident rates, and insurance regulations, impacting costs.

- Age and Experience: Young drivers often face higher premiums to their higher risk profile. experienced drivers with a clean record enjoy more favorable rates.

- Driving History: Your past on the road matters. Accidents, violations, and claims history play a significant role in determining premiums.

- Vehicle Make and Model: The type and age of your vehicle impact costs. High-performance or luxury cars may result in higher insurance expenses.

- Coverage Selection: The type and level of coverage you choose influence costs. Comprehensive coverage, which offers broader protection, typically comes with a higher premium.

- Discounts and Incentives: Safe driving programs, good student discounts, and policy bundling can lead to reduced premiums.

The Pulse of Your Budget: Average Auto Insurance Cost Per Month

Understanding average auto insurance costs per month goes beyond the numbers. Armed with this awareness, individuals can proactively seek ways to reduce costs, from improving driving records to taking advantage of available discounts.

Age, Location, and Insights: The Perfect Equation

Analyzing average car insurance costs per month by age and state adds an extra layer of insight. Each state has unique insurance regulations, economic influences, and risk factors that contribute to premium variations.

Conclusion: Equipping Financial Decision-Making

WalletHub’s meticulous study on the average price of car insurance goes beyond statistics; it’s a roadmap to informed financial choices. In a world where budgeting is paramount, comprehending the intricacies of the average car insurance cost empowers individuals to make deliberate decisions.