Many factors can affect how much your car insurance costs. such as the make and model of your vehicle. WalletHub has analyzed the factors that affect the cost of car insurance and compiled state-by-state comparisons of insurance companies’ rates. Read on to find out how to lower your insurance costs and make sure you’re covered. Continue reading to learn more about how your gender, make and model affect how much your auto insurance will cost.

WalletHub’s analysis of factors that affect car insurance cost

The area you live in can influence the cost of car insurance. Zip codes can affect insurance rates in California by as much as 91%. A street address is also an important factor. Urban areas tend to have higher crime rates and more accidents, while more rural areas have fewer car accidents and fewer property crimes. State regulations on auto insurance are also important, as they determine how much people pay in insurance premiums.

Consumers have mixed reactions to credit scores. About one-third of respondents believed that credit score is related to the cost of car insurance. While almost an equal number had no idea it would be affected. However, about half of the respondents agreed that good credit leads to a better rate. WalletHub’s analysis of the factors that affect car insurance costs highlights the importance of credit scores in determining premiums.

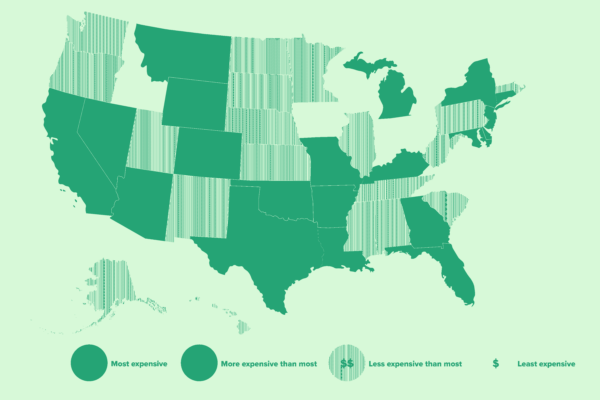

WalletHub analyzes the worst states for car insurance based on factors such as average premiums, coverage options, and the regulatory environment.

State-by-state comparison of insurers’ rates

A state-by-state comparison of insurance companies’ car insurance rates can give you a clear picture of which states offer the best deals. Each state has its own insurance laws. The rate mainly depends on the location. Insurance companies assign different risk levels to ZIP codes and consider the frequency of car accidents in determining premiums. However, while each state has different laws and regulations, some do not allow insurance companies to use certain factors to determine premiums.

No-fault states like New Hampshire are ideal for low-income drivers because they promote a competitive insurance market. Even no-fault states like New Hampshire have low populations, which means insurance companies have to accept a wide range of drivers, including the uninsured. Moreover, the average income is higher in this state, meaning fewer accidents.

When comparing rates for car insurance, several factors go into determining the cheapest and most expensive states. Age, driving history, and the car you drive all play a role in determining how much you pay for insurance. For example, drivers in Michigan pay an average of $4,386 for minimum coverage, more than three times the national average.

State high-cost insurance laws require drivers to carry PIP (personal injury protection) insurance, which increases the cost of minimum coverage. But when it comes to low-cost states. Then Maine and New Hampshire are still the best places to get auto insurance. Idaho and Wisconsin moved up one spot to third and fifth, respectively, so check to see which one offers the best coverage.

Impact of gender

Women pay more for car insurance than men, but gender differences in rates disappear as drivers age. The effect of gender on insurance rates becomes more pronounced when adding a teenage driver to the policy. Age is also an important factor to consider when looking for an auto insurance company. In some states, including California, Hawaii, and New Jersey, credit scores as factors in determining the price of auto insurance.

However, there are some benefits to eliminating this factor in auto insurance rates. The financial disadvantage of individuals facing such cost disparities is obvious. Many states have already done away with this practice. California, Massachusetts, Michigan, North Carolina and Pennsylvania have done so. Additionally, the United States has introduced Senate Bill 231 which would remove the gender factor from car insurance rates. The legislation is expected to pass this week, which overlaps with Women’s History Month.

The gender factor is controversial. The Consumer Federation of America, a non-profit organization, conducted a study to determine how gender affects insurance premiums. While the gender rating factor has been eliminated in six states, they found that it is still heavily used in some other states. However, this disparity in car insurance is unlikely to last. According to a recent survey, 62% of insurance companies grade customers based on their gender, with women getting slightly better ratings than men.

Impact of make and model

While car insurance rates vary between different vehicles, one of the main factors affecting their cost is the car model. High-end luxury vehicles often cost more to insure due to increased prices. Insurance companies also spend more on repairs and replacement parts when a luxury car is involved in an accident.

While car insurance rates are directly tied to the make and model of the vehicle, other factors can also influence the cost of your policy. Your zip code and driving history also play an important role. Additionally, the type of coverage you choose can affect the cost of your policy.

Another factor that affects car insurance rates. It is the body style of the vehicle. SUVs cost more to insure than smaller cars. Large SUVs can be more expensive than small cars because they pose a risk to other vehicles in the event of an accident. Additionally, different car models come in different trim levels or versions. While the base model may be the least expensive, a sporty car will have more expensive liability insurance than a sports car.

The make and model of a vehicle can also influence its insurance premium. In general, larger cars cost more to insure, as they are larger and more expensive. A larger car will cost more to repair than a smaller car, which is a major factor for insurance companies. A luxury vehicle with high-safety equipment can often qualify for a premium discount.

Impact of location

Car insurance rates vary by location, with metropolitan areas presenting higher costs due to higher crime rates and suburban areas lower premiums. Among the various factors that affect car insurance costs, location is one of the most important. Insurance companies scrutinize statistics to determine where drivers file the most claims and therefore charge higher premiums. More population means more cars on the road, and more accidents mean higher premiums. Additionally, an area with more cars means risks such as animal collisions.

Insurance companies also consider the proximity of neighboring buildings to the insured’s home while calculating their premiums. As a result, a 30-mile trip from one neighborhood to another increases the vehicle’s risk, while a shorter trip from another can result in lower premiums. Additionally, proximity to another home can increase the risk of fire, as fire spreads more quickly.

The location also affects the cost of living. The cost of living in one state is significantly higher in certain states than in another. For example, going from Pittsburgh to Philadelphia can increase a driver’s car insurance rate by more than $1000.