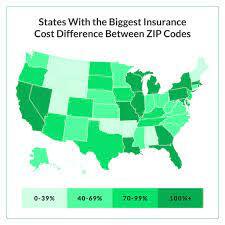

The best car insurance rates by zip code, so it pays to compare several zip codes. For example, urban zip codes cost 40% more than rural zip codes. Some companies have more competitive rates because they specialize in the same drivers as you. If you live in an urban area, some companies offer better rates than in rural areas. Listed below are some tips for finding the best rate for your zip code.

State Farm Car Insurance Rates

When it comes to car insurance rates by zip code, State Farm is no exception. Their premiums are comparatively higher than most companies in Michigan and New Jersey. However, their rates are comparable to other leading providers. Most states do not allow insurance companies to consider age when determining premiums. However, young male drivers generally face higher premiums than drivers over the age of 25.

Insurify’s Consumer Scoresheet compares various insurance providers based on financial strength ratings, AM Best’s ratings, and Consumer Reports’ customer satisfaction surveys. It also considers user-generated company reviews and mobile app reviews. It shows that state farms consistently outperform farmers on these criteria. The average monthly rate is significantly lower.

State Farm also offers comprehensive collision coverage. Which will cover the cost of repairing other people’s cars if your car gets damaged. In addition to liability coverage, you should also get uninsured and underinsured motorist coverage, which will pay for your expenses if the at-fault driver has minimal or no liability insurance. State Farm offers an extensive list of coverage options and can tailor your insurance plan to fit your needs.

In addition to the mobile app, the State Farm website offers quotes. You can also contact the agent by phone, fax, or mail. The State Farm car insurance quote calculator will generate three quotes for you. The more comprehensive your coverage, the higher the premium. The State Farm mobile app will also help you stay connected with your insurance agent if you have any queries.

Geico Car Insurance Rates

When you’re wondering how to lower your Geico car insurance rates, here are some helpful tips. Increasing your coverage limit will lower your monthly premium, but you’ll pay more each year. There are many different coverage levels to choose from. Some states have lower coverage rules. Geico offers many discounts, and 67% of policyholders are very satisfied with their discounts. A usage-based driving program, DriveEasy, can help you secure lower rates on your policy.

USAA Car Insurance Rates

Despite their high-profile name, USAA’s insurance policies may not be available to everyone. For a limited time, the company is offering a free quote on their website. It offers more than a dozen discount options. But it is not available in all states. USAA also offers to file claims online only. Their claims support line is unavailable to non-members. This lack of accessibility costs them points in the ease of doing business category.

Insurance companies take gender into account when making their rates and use accident statistics to conclude that men are generally higher-risk drivers. Although gender-based insurance is illegal in most states, USAA charges men more than women until they reach age 25. This is because they believe that men’s driving habits improve with age. There are many ways to save on car insurance from USAA.

USAA also offers a free quote on its website. You should know that you have to click on some pages to access it. Unlike other insurance companies, it is not featured on the main page. You will need to scroll down the page and click on “Get a Quote” to access the quote. After you fill out the form, your personalized quote will appear. Be sure to enter your SSN and other relevant information to get the best price.

Another benefit of choosing USAA car insurance is that it offers rental reimbursement. You can get a rental car while your vehicle is being repaired. Representative rates for these insurance plans are $831 for low coverage, $882 for medium coverage, and $939 for high coverage. You can also upgrade your coverage if you want for an additional $9 per month. USAA does not offer these features to all of its customers. Discounts and bundling options may also impact the final car insurance rates by zip code.

Amica Car Insurance Rates

Amica car insurance rates are competitive with other car insurance companies. The company offers various discounts including loyalty discounts and multi-car insurance discounts. If you drive more than one vehicle, you may be eligible for a multi-car discount of 25%. Drivers under the age of 30 who are children of people who have been with Amica for five years or more are eligible for the Young Driver Discount. Young drivers can save up to 25% on car insurance by purchasing an anti-theft device.

Amica offers several discounts based on your age and driving record. For instance, drivers with good credit, clean driving records, or a history of low-risk accidents are eligible for a low-cost policy. Good students, drivers with multiple cars, and people who pay in full for their policies are eligible for discounts. Good students may also be eligible for good student discounts.

Nationwide Car Insurance Rates

If you can find a customer service car insurance company for you, consider Nationwide. According to a study by the National Association of Insurance Companies, the company had fewer baby boomers and an overall customer Johnson rating of 876. It’s not just the company’s reputation that appreciates it. So is their customer service. by name

A lower credit score means you may experience more insurance losses, and insurance companies are quicker to charge higher rates. The average cost for a driver with poor credit nationwide is $1,533. Which is still lower than most other companies. You can also get discounts by comparing rates from other companies, including State Farm and Progressive.