You should look at the cheapest insurance for new drivers to get the best coverage at the lowest price. It is possible to find cheaper insurance if you follow some simple tips. Maintaining a clean driving record, taking a defensive driving course, and raising your deductible can all help lower premiums. Many providers have special programs designed for new drivers that lower the cost of insurance. It is also a good idea to compare insurance rates from different providers to see what’s the best option for you.

Geico – Cheapest Insurance For New Drivers

Although the company has high rates for new drivers, Geico is one of the cheapest policies available nationwide. Its rates depend on many factors, including your driving record and the location you live in. For example, drivers living in small towns will be charged far less than those living in the city of Miami, which is among the most dangerous places to drive. Other factors can affect the premium you pay including your credit score, the type of car you drive, and the number of drivers on your account.

There are many benefits to getting insurance through Geico, including discounts for driving safely, lowering your monthly payments, and great customer service. For instance, you can get a free car insurance quote by joining Geico’s membership program. Besides being a member, you can also take advantage of other discounts that GEICO offers. These include discounts for safe driving and for using anti-theft devices in your car. These discounts can reduce your overall cost of car insurance and can result in significant savings.

Geico has the cheapest car insurance for new drivers. However, if you’re a veteran driver, you might find a cheaper policy with another company. The best car insurance quotes depend on several factors, including your driving history and location. To get the cheapest quote, compare multiple quotes. Geico Insurance also has discounts for drivers with multiple cars and students. But, when geico new driver insurance costs, you want to choose the cheapest option for your particular circumstances.

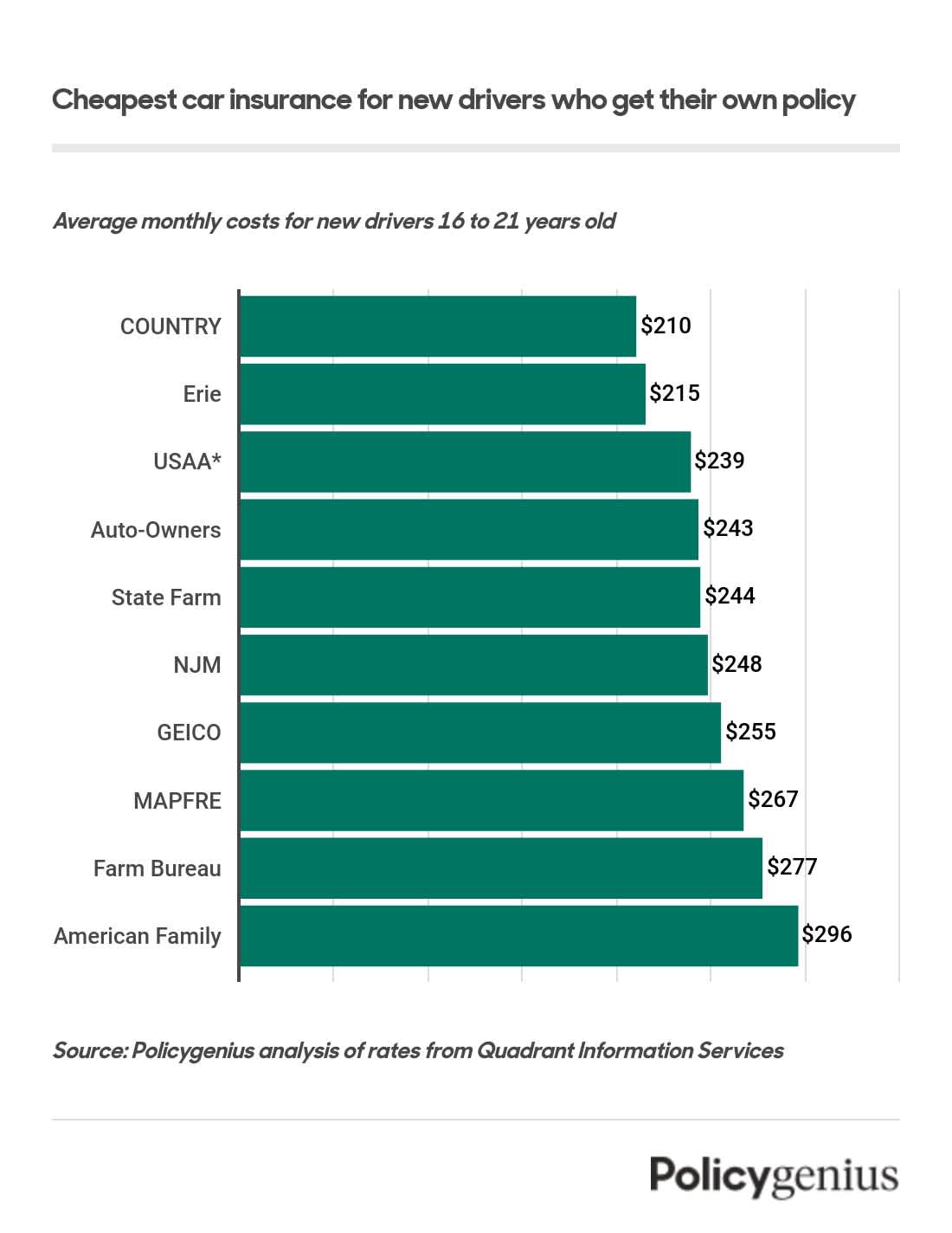

Although Geico is a good option for new drivers, it can be difficult to find the right policy. If you have a good driving record, you may want to check out the other companies on the list. State Farm, Progressive, and Nationwide offer cheap car insurance for new drivers. However, these companies aren’t the only insurance companies that provide low rates. If you’re looking for affordable car insurance for new drivers, consider USAA. This company is a good option for military families.

Allstate – Cheapest Insurance For New Drivers

While Allstate is a long-established name in the car insurance industry, the company may not be the best option for new drivers looking for the best prices and claims service. In addition, its car insurance rates are some of the most expensive in our review. And Allstate doesn’t have the best customer service either. In addition to its high rates, the company doesn’t offer the best customer service, but it is still one of the cheapest options for new drivers.

It’s important to understand that auto insurance rates vary significantly by city and age, and they depend on a variety of factors, including the driver’s credit score, driving record, and age. In the case of new drivers, the cost of car insurance will cost more for experienced drivers. However, if the driver is a college student, they will likely qualify for lower rates.

In the case of new drivers, Allstate offers the lowest rates for minimum coverage car insurance. Typically, new drivers can expect to pay $2,743 per year for car insurance. Allstate’s policy will cost just $1,205 per year, or $56% less than State Farm’s. For full coverage insurance, the best option is to get a policy from State Farm which costs $3,308 per year and $276 per month. By comparison, the national average for full coverage car insurance is $6,527 per year.

While Allstate is not the cheapest insurance for new drivers, if you have a low credit score, you may be able to find affordable car insurance rates with Allstate. They have several discounts for students, new drivers, and those with poor credit. A good credit score can save you hundreds of dollars per year on car insurance. With all these benefits, Allstate is an excellent choice for new drivers.

Direct Line

Direct Line is a leading car insurance provider in Europe. It offers many advantages to clients, including cheaper premiums and a variety of special features. It also has the lowest deductible of any insurance company for new drivers. However, if you’re a new driver, you may need to opt for a specific cover such as third-party insurance or comprehensive cover to avoid high premiums.

Generally, new drivers will pay a higher premium than those who are more experienced, but by comparing quotes, you can find the best deal for you. Insurance rates are affected by many different factors, including age, gender, location, and credit score. Young drivers, in particular, are at higher risk of insurance than other drivers, so they’ll pay more for insurance during the first few years of their driving career. In the long run, though, they’ll be rewarded with cheaper premiums and more coverage as they gain experience.

Direct Line DrivePlus Black Box Insurance

The Direct Line DrivePlus black box insurance policy has several benefits that young drivers may want to consider. It is one of the most comprehensive insurance policies available in the market. The company’s telematics technology helps the company assess how safe a young driver is and rewards good driving behavior. It is easy to install and offers discounts for good driving. This policy also offers optional extras such as a self-fitting black box.

Direct Line DrivePlus is an insurance policy that requires a plug-in device to track your driving habits. It then analyses the data you provide and calculates your savings for the following year. Drivers can monitor their driving performance through the mobile app or online dashboard. The company provides regular feedback and has a high customer satisfaction rating. Although many customers have expressed concern about the lack of a 24-hour claims service, it is the cheapest insurance for new drivers.

Black box insurance can take on different forms. Some black box policies use matchbox-size trackers that you install yourself while others use windscreen tags. Still, others do not require black box technology. Some will track your phone and your car’s mileometer instead. Some of these policies are more expensive than others, but they do put you in control of your insurance costs. And once you become a better driver, you may even get other rewards.

If you are a young driver, you may want to consider black-box insurance. These policies are specially designed for young drivers. And much cheaper than traditional car insurance. They also use GPS technology to monitor driving habits and give you an average driving score. They will be able to see your driving history and reward safe drivers with lower premiums. This type of insurance is aimed at new drivers and young adults and has several benefits.

Allstate Allstate

If you’re a new driver looking for the best car insurance policy at the lowest price, Allstate might be the best option. It offers three tiers of auto insurance: low, medium, and high. Low coverage requires minimal coverage while medium and high coverage offer higher limits and lower deductibles. Allstate has a good accident waiver program, which does not increase If your premium continues if you have an accident Accident or get speeding tickets, your Allstate rates will increase.

Insurers offer many discounts to new drivers. For example, drivers who have “B” averages are eligible for the Good Student Driver Discount. Another good student discount allows young drivers to save money if they attend school 100 miles away from home. And, if you’ve been an Allstate customer for three years, you’ll get the Renewal discount if you haven’t claimed for three years.

Allstate auto insurance rates are based on average rates across the country and take into account many factors. A driver’s age, driving record, credit score, and city are all factors in determining the cost of coverage. New drivers are typically more likely to get into accidents, so their rates are higher than those of older drivers. But, once you hit 25, the rates will go down. If you’re a new driver, Allstate may be the best option.

The best auto insurance for new drivers is available for those under 25. According to MoneyGeek, Allstate is the cheapest insurance for new drivers, and the company’s accident forgiveness policy is a huge benefit. Your first accident will be forgiven if you’re insured through Allstate, and you’ll receive a $100 incentive for every subsequent accident-free year. But be sure to shop around to find the best deal.