If you are in the High Risk Auto Insurance category, there are several things you can do to lower your premiums and improve your driving record. The best way to get your insurance premiums lower is to drive safer. One of the best ways to do this is to follow the speed limit. Most companies will reward you with a discount for driving the speed limit and following traffic laws. Additionally, many insurers offer discounts for taking driver safety courses. By taking a course, you will remove points from your driving record, which will help you lower your premiums.

Bad credit history – High Risk Auto Insurance

A bad credit score can increase your car insurance premiums. The insurance industry calculates how risky you are based on your driving record. For example, people with more traffic violations, more accidents, and higher claims can be classified as high risk drivers. However, there are ways to mitigate the negative effect of bad credit. One way is to build a credit history by becoming an authorized user on your parent’s credit card accounts.

Credit scores are used for many financial transactions. Car insurance premiums are no exception. Your score is a snapshot of your financial history and reflects your payment history and the amount of available credit you have. While your score is an indication of your financial responsibility, it does not reflect how much money you earn or save. A good insurance company will offer enough coverage to cover the costs of an accident. But it is important to remember that there are certain things you can do to keep your score as high as possible.

Paying your bills on time is a key factor in your credit score. Insurance providers are more likely to decline applicants with poor credit. Missing payment dates will cause your score to go down. But regular payments will demonstrate to insurance companies that you are financially responsible. As a result, your credit score will increase. So don’t delay in getting a car insurance policy today. You can do this by following these tips.

While your car and driving history play a large role in determining the cost of your car insurance, your credit history is also important. People with poor credit tend to file more claims than those with good credit, so it is important to stay protected. Also, driving without insurance can damage your driving record and get your license suspended. These risks are the reason why many people choose to avoid getting auto insurance. There are many reasons to do this, and the benefits outweigh the negatives.

Poor driving record – High Risk Auto Insurance

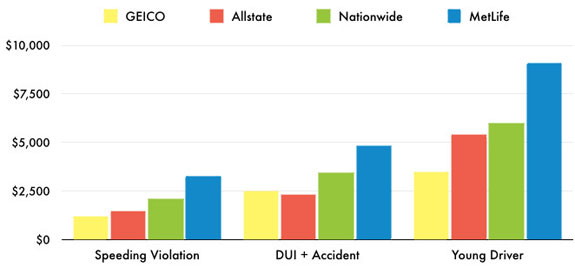

Insurers that specialize in insuring high-risk drivers may require high-risk drivers to obtain special policies. A poor driving history can result in a higher premium than a clean one. Having a DUI or too many traffic tickets is often a cause for a higher premium. These drivers often must obtain SR-22 car insurance or high risk auto insurance policies. Here are some tips to help you get the lowest rates on high risk insurance.

One of the keys to finding good bad driving record auto insurance is to have the right information. Many insurance agents will recommend that a customer contact another agent if their company isn’t a standard one. You should be sure to provide the correct information to any auto insurance agent you speak with. This way, they will be able to tell whether they can help you or not. By supplying your information correctly, you will be able to find an agent who is willing to help you.

Another way to lower your premiums is to drive safely. Driving within the speed limit is the best way to avoid tickets and accidents. You can also qualify for discounts by taking driver safety courses. By taking these courses, you will remove points from your record and decrease your premiums. Even if you have a bad driving history, you should always strive to improve your driving habits. The more you drive safely, the more your premium will go down.

Most insurers will look at your past five years. The effect of a ticket decreases over time, so it is best to avoid tickets for as long as possible. State Farm notes that a ticket from one year ago has a greater impact on your insurance premium than a ticket from five years ago. You should also be aware that driving without insurance can get your coverage suspended for six months.

Age

The age of high risk auto insurance varies based on the gender and experience level of the driver. Insurers tend to consider new drivers under 25 years of age as high-risk. After age 25, insurance premiums typically decrease, but after age 65, they start to go up again. The number of traffic fatalities among drivers over 65 years of age was 6,907 in 2018, or 19% of all fatalities. But how can you reduce your premium? Below are some tips to help you lower your premiums.

One of the best ways to reduce the price of your high-risk auto insurance is to drive as safely as possible. Driving safely and responsibly will lower your risk significantly. Insurers will generally offer lower rates to safe drivers if they stay with the same insurer for three years, have no tickets or accidents, and stay away from speeding. However, there is no one-size-fits-all rule when it comes to reducing your risk.

Insurers will look at your credit score when calculating your premium. People with low credit scores are generally considered high risk. But your age also plays a part in determining your premium. If you have poor credit, you’ll likely be considered a high-risk driver. Also, you may be a teenager or a senior citizen, which will increase your premium. If you’ve had an accident in the past, the rate for this type of insurance will increase significantly.

As a general rule, auto insurance costs decrease as we get older. However, if you have several accidents or traffic violations, the age of high risk auto insurance begins to increase. You can also lower your premiums by keeping good grades and avoiding traffic violations. Generally, this will help you drive more safely. If you drive safely and responsibly, you can keep your rates low until the age of fifty. But if you drive recklessly, your premium will shoot up even higher.

Sports car ownership

Because sports cars are usually high-risk vehicles, they often require higher auto insurance premiums. This is because they are more expensive to repair and manufacture. And therefore more likely to be involved in accidents. In addition, you might get more tickets as well. The Insurance Institute for Highway Safety has acknowledged that sports cars are more dangerous. However, efforts are being made to make it more secure. Insuring your sports car should be a top priority, but there are some tips to keep in mind when looking for an auto insurance policy.

First of all, you should make sure you understand why sports cars are considered high risk vehicles. They are more likely to be stolen than standard sedans. Furthermore, sports cars tend to cause more damage in a wreck than standard cars. Having a sports car on the road can increase your premiums by several hundred dollars. Thankfully, there are some ways to lower your auto insurance premiums. Consider this article to find the best auto insurance for sports car owners.

Another good way to save money on sports car insurance is to use discounts. Some sports car insurers offer discounts for certain things, like anti-theft devices and window etchings. Other ways to save money on sports car insurance include multi-car insurance, electronic payment transfers, and multiple-car policies. You can find the best sports car insurance rates by using your ZIP code. Then, take advantage of these discounts to make your premiums even lower.

While reducing your sports car insurance premiums is important, you should also consider taking a defensive driving course. Taking such a course will make you a better driver than the average driver and reduce your insurance premiums by as much as 10%. You can also opt to use anti-theft devices such as alarms. While you might be worried about the added expense, these can be worth the savings over time.

Tickets and accidents

When you get tickets and accidents on your driving record, you are considered a high-risk driver. The insurance company will charge you more for your coverage, and you may lose it entirely. If this sounds familiar, read on. We’ll break down why you’re considered high-risk and how you can lower your premiums. Tickets and accidents aren’t the only reasons you need high-risk auto insurance.

Despite the name, drivers with tickets and accidents are often considered high-risk by insurance companies. This classification may prevent them from receiving favorable rates, but reputable insurance companies offer high-risk plans to drivers with bad driving records. There are state automobile insurance programs for high-risk drivers that can provide the protection you need. You can visit one of these programs by entering your ZIP code and finding a policy that suits your needs.

Generally, if you have one or more tickets or accidents on your driving record, you’ll pay a higher premium than someone without these issues. However, this high premium does not last forever. It usually ends after several years. If you’ve had multiple accidents and poor credit, your insurance premium will be higher for many years. To avoid being considered a high-risk driver, try to drive safely and carefully. Keep in mind that car insurance companies only look at the last three or five years of your driving history.

A recent study found that speeding accounted for 26% of traffic fatalities in the United States. Moreover, speeding tickets can also raise your rates. If you’ve received several speeding tickets, you’ll likely be labeled a high-risk driver. Additionally, these types of tickets also result in points on your license, which will raise your rate further. But some states allow you to take a defensive driving course to avoid points.