If you own a car and are looking for insurance, nationwide bank mobile insurance is one of your best options. However, it is not without its flaws. Read on to learn more about its costs, exclusions, and customer service. Nationwide bank mobile insurance may not be for you, so be sure to read these disclaimers carefully. Read on to see how this insurance policy stacks up against its competition. There are some major advantages to nationwide bank mobile insurance, so read on and make the right choice.

Disadvantages of nationwide bank mobile insurance

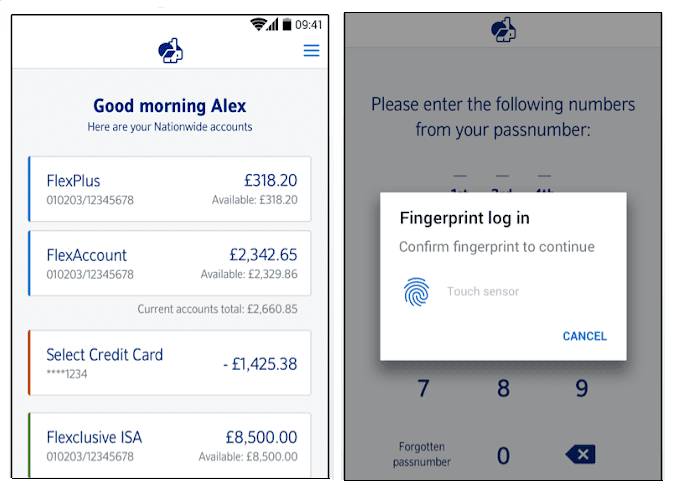

The biggest benefit of a Nationwide Bank mobile insurance policy is that it covers both your phone and your tablet. This policy is offered free of charge when you open a bank account. However, there are some disadvantages to this mobile phone insurance policy. You can only make four claims a year and the additional charges are very high. Moreover, you can’t use multiple devices and pay for extra cover.

Although getting mobile phone insurance through FlexPlus is a simple current account, the service has some limitations. The first is that you can only make one successful claim every 12 months. In the case of a joint account, you can claim four times a year. However, if you need to claim while abroad you will have to pay the full cost of the device. If you’re traveling for business or pleasure, you’ll also need to pay for international roaming charges included in mobile phone insurance.

Cost – Nationwide Bank Mobile Insurance

Obtaining Nationwide mobile insurance coverage is simple, even if you’re not planning on owning a mobile phone. The bank’s FlexPlus current account offers worldwide cover for family phones of up to PS1,500 in value. This mobile phone insurance also covers unauthorized calls for up to 24 hours. It also covers accessories. Using a FlexPlus current account to purchase mobile insurance can save you money by avoiding the costs of multiple policies.

Axos Bank is owned nationwide. And it offers special offers to its members. It is not affiliated with any bank, lender, or any other organization. Nationwide does not approve or reject applications from the public, and the company does not guarantee the products or services offered by Axos Bank. It does not endorse any specific product or service offered by Axos Bank. To get a free quote, use the Nationwide website.

Another advantage to Nationwide mobile insurance is the deductible savings bank. If you are a regular user you can create a bank account and earn extra cash every month. You can even save your money by making a few payments every month. The monthly cost is PS13, and MPIDs start at PS400. However, there are a few disadvantages to this mobile insurance policy. There are many other options available, such as dedicated mobile phone insurance. If you’re not interested in buying a mobile phone policy, Nationwide’s offer might be right for you.

Excess

If you are in the unfortunate position of having your mobile phone stolen or damaged. So you might be wondering how to claim the money back. Well, no need to worry. Because you can do this online or by phone. All you have to do is register your mobile phone details with Nationwide and provide as much information as possible about the incident. It will also help if you have a police crime reference number and a debit or credit card to pay the excess.

Customer service

If you’re looking for a phone number where you can contact customer service representatives for your Nationwide Bank mobile insurance policy, there are a few options. If you’re not comfortable calling their customer service lines, you can always try contacting Nationwide via its Facebook page or live chat on its website. However, be aware that it may take some time for a customer service representative to respond to your query. To avoid this it is important to have as much information as possible about the problem you are experiencing.

Another option is to use DoNotPay. This online service enables you to avoid long phone calls. While the service is available 24/7, it can be slow. If you’re in a hurry to contact a representative, it’s best to go online and submit a support ticket instead. This way, the representative will be able to address your concerns much faster than if you call their customer service line. If you’re not a customer yet, it might be worth trying out a doNotPay service first.