Are you thinking of purchasing Nationwide home owners insurance Read on to learn about Nationwide’s underwriting practices, customer service, and Fair Housing Act compliance. You will also learn about their home security features. And we’ll review the cost of a nationwide homeowners insurance policy. If you are looking to buy home insurance online, you have come to the right place. The process is straightforward and may require some basic details about your home and your personal information.

Nationwide Homeowners Insurance Review

When it comes to customer service, a recent J.D. of homeowner insurance companies. Nationwide is generally rated below average in power studies. The company scored 808 out of 1,000 on a scale of 1 to 10 for overall customer satisfaction. That’s lower than the national average, but customers still have high praise for the company’s customer relations and overall complaint rates are lower than the industry average. Consumers can also compare nationwide home insurance prices with other companies.

A Nationwide home owners insurance review reveals a wide range of coverage options and discounts. Choosing a policy that suits your needs can help you find the right insurance policy at the lowest price. If you’re looking for a budget option, you should compare Nationwide’s home insurance with top-rated insurance companies. This will give you a better understanding of the company’s homeowners insurance. So, get the most coverage for your money.

Compliance with the Fair Housing Act

The Fair Housing Act prohibits any form of discrimination. including statements, disclosures, policies, practices, and locations. In addition, the Act protects persons with disabilities and requires businesses to make reasonable accommodations. They must be open and transparent. How do they determine if their practices are discriminatory? If they are not, they are subject to legal action. Some companies have taken steps to ensure they comply with the Fair Housing Act.

HUD has long interpreted the Fair Housing Act as a federal statute. which requires private companies to disclose certain practices that adversely affect the rights of disadvantaged individuals. Texas Department of Housing and Community Affairs Vs. Its 2013 disparate impact standard regulation was amended to reflect the Supreme Court’s ruling and incorporated the Inclusive Communities Project, Inc., and was amended to clarify the burden-shifting test. The new regulation also highlights the definition of “disparate impact” in Title VII and the burden-shifting framework.

Underwriting practices

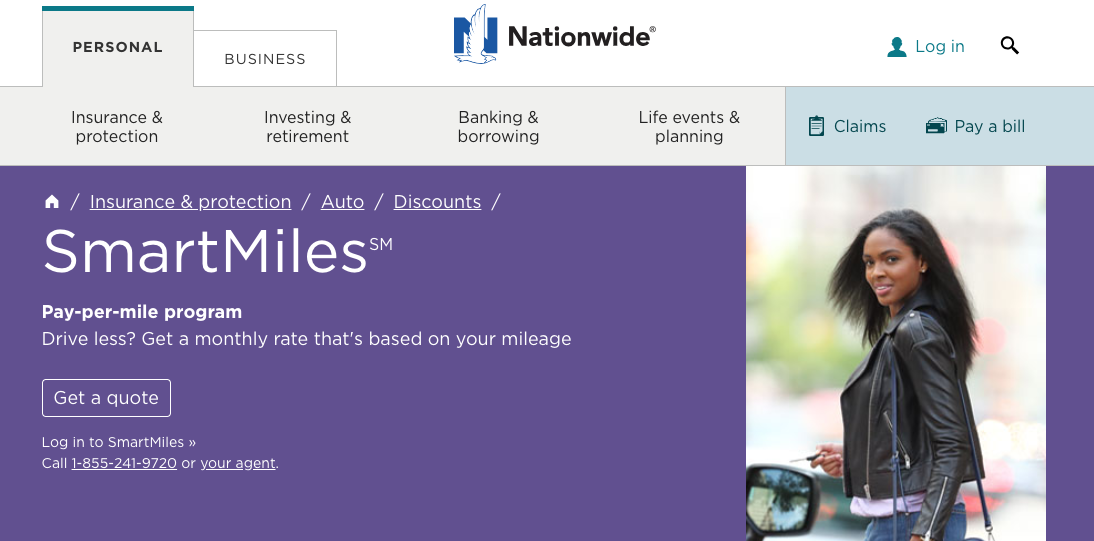

For starters, Nationwide offers a variety of alternative coverage options. Some lenders require you to have flood insurance. While some homeowners find earthquake insurance beneficial. You can get a discount by adding this coverage to your policy. Nationwide offers a wide range of discounts, including new-home discounts. Whether you’re a first-time home buyer, a homeowner’s discount, or live in a gated community, Nationwide offers options to fit your needs.

When choosing an insurer, be sure to read reviews about their financial stability. Homeowners insurance is essential protection So it is important to choose a company with a solid financial foundation. Thankfully, Nationwide has been in business for nearly a century, making it a solid choice for homeowners insurance. A.M. Has an excellent financial strength rating from respected industry sources such as Best

Nationwide insurance customer service

In general, Nationwide Insurance customer service representatives can help you with a wide range of issues. They may provide you with information about your investment account, process new claims, or track existing claims. Keep in mind that these representatives do not make insurance decisions or set premium rates. You should also remember that they are not responsible for making investment decisions. They may not be the best choice to answer your questions about Nationwide Insurance.

How to Get Discounts on Homeowners Insurance

Discounts on homeowners insurance can vary widely across the country. Many insurance companies offer discounts for certain groups of homeowners. Such as those with good credit or who have not filed a claim in the last five years. Depending on your unique profile, you can save up to 15%. But make sure you read the fine print! This discount may not be available in your state. If you live in a gated community or are a teacher you are not eligible for the discount.

You should try switching insurance companies to get discounts on your home insurance. Most insurance companies offer limited-time loyalty discounts to keep you as a customer. You should carefully weigh the benefits of loyalty discounts against the costs of switching companies. Consider whether the risk of leaving your current insurance company is worth the discount. Many insurance companies offer modest discounts to those living in gated communities. Hold neighborhood watches or become members of homeowner associations.

You can also apply for a discount on your nationwide home owners insurance based on the age and type of your roof. Whether you’re a first-time homeowner, live in a gated community, or have multiple policies, there are many additional discounts to consider. If you own a new home, you can also get a new home discount. You have owned a home owned by another insurance provider for many years. Then you may be eligible for an earlier insurance discount.