If you are looking for a new laptop or need to replace your existing laptop, you should consider the nationwide laptop insurance policy status. This variety has many benefits including a quick and easy claim process. Listed below are some of the more popular options. These policies take screen replacement, accidental marks, and anti-triangulation. Some are better than others. It also provides life support free of medicines.

Excess

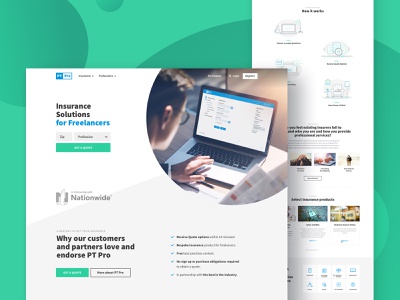

Buying laptop insurance can seem difficult. If you own a Dell computer, you’re not alone. Additional nationwide laptop insurance is offered by Dell and covers a wide variety of new laptops. You must register your plan within 30 days of purchase and determine the cost, deductible, and length of coverage. If you don’t register your plan within three days of purchase, you can still register it later. Doing this can save you time while filing a claim.

Nationwide laptop insurance reviews consistently highlight the reliability and efficiency of their coverage.

Replacement cost coverage

Most people don’t know that they can purchase replacement-cost laptop insurance for just a few dollars a year. This policy will reimburse you for a comparable model if you are unable to repair or replace your laptop. If you are looking for a laptop replacement plan, here are some tips to consider. Replacement cost laptop insurance isn’t as expensive as many people think, and it’s a great way to protect your investment.

The replacement value of your laptop is the maximum amount that the policy will pay out. You can purchase replacement coverage for the cost of the laptop as well as any personal items you own. This type of insurance. Replacement costs may exceed cash value. Replacement costs may include coins, certain precious metals, jewelry, or semi-precious stones.

A nationwide laptop insurance policy will cover the cost of replacing your laptop if it is due to an accident, power surge, lightning, or theft. In most cases, homeowners insurance will cover the replacement cost of the laptop up to $1,500. You will have to pay a deductible amount, which may be more than the actual cost of your laptop. For maximum protection, you should buy laptop insurance. But buying laptop insurance is not a good idea because you can afford it.

Nationwide homeowners insurance coverage is designed to provide comprehensive and reliable protection against various risks.

Actual cash value coverage

When shopping for nationwide laptop insurance, be sure to consider the various valuation methods offered. Actual cash value covers items such as those that have been in your possession for a long time. which may be worth only a fraction of their replacement value. Replacement cost coverage is a more expensive option. You may need it if your laptop costs more than you originally paid. Replacement cost covers the cost of the item including depreciation.

Another consideration is the type of coverage you want. Some policies cover all types of new laptops. You must register your plan within 30 days of purchase. After you purchase a Dell insurance policy, you’ll need to choose your deductible and length of coverage. This will save you time if you ever need to file a claim. If your laptop is worth $1500 now, it will depreciate in two years.

Replacement cost value and actual cash value are two terms that describe the coverage of items. The latter is a more expensive option, but it’s worth looking closely at every word. In insurance terms, the replacement cost of an item is the total cost of the item. Deduct any depreciation. The actual cash value will almost always be less than the original cost. The same goes for laptop insurance. Choosing a provider for international laptop insurance is to ensure comprehensive protection.

Asurion

Asurion offers a multi-device protection pack that covers three Litel devices, plus out-of-warranty protection. This plan is for both laptops and tablets and requires a newer operating system. Customers can add up to two additional devices to their existing policy at any time. The warranty service of the company is second to none. If you have all the utilities, you can take advantage of the multi-device protection pack by bundling them into your existing policies.

Asurion’s Home+ plan offers up to $2,000 in repairs per approved claim. Can be repaired using non-original parts. A replacement product may be new, refurbished, or remanufactured. You have to wait 30 days before your policy starts, and the service you get is through a network of highly managed third-party service providers. Its prices are competitive, and it covers multiple devices.

Asurion’s subscription-based security plan protects multiple devices and also offers a bundled home insurance policy. Customers can also access an extensive repair network, with 700 uBreakiFix locations across the US, supporting Asurion’s aftermarket mission to reduce e-waste and extend device life.

The company website does not clearly describe company policy. It is unclear whether the 7-day period begins on the date of the email message or the day Weiner received his replacement smartphone. That’s not enough time to fully investigate and test a new device, let alone try another brand. As a result, Wenner has decided to cancel his smartphone insurance with Asurion. Although Asurion has an A+ rating from the Better Business Bureau, customer complaints regarding the company’s customer support are numerous. Nationwide laptop insurance cost vary depending on factors such as coverage level, deductibles and specific policy details.

Worth Ave. Group

Worth Ave. The group offers comprehensive insurance coverage for computers, tablets, and other electronic devices. Their policies protect against accidental damage and natural calamities. Also covers the cost of e-readers and digital cameras. With their unlimited, full-replacement-value coverage, you can rest assured that your premiums won’t increase if you need to file a claim. This nationwide coverage also extends to almost any peripheral you have, such as a digital camera.

The company offers student discounts, as well as student and teacher discounts. Company discount codes must be applied to items in the shopping cart. Click on the code to see the discount price. You will be prompted to enter the code when you check out. Then, enter the code during checkout, and the total price will reflect the discounted price. This is an easy way to save money and you can apply multiple discounts at once.

While buying laptop insurance, check the coverage limits and additional benefits. Many insurance policies cover common perils such as spills and power surges and will compensate you if you need to repair them. A cracked screen can cost hundreds of dollars, and a laptop insurance policy can help you avoid the financial burden. Because laptops are expensive, the insurance company covers situations that are not covered by homeowner’s insurance.