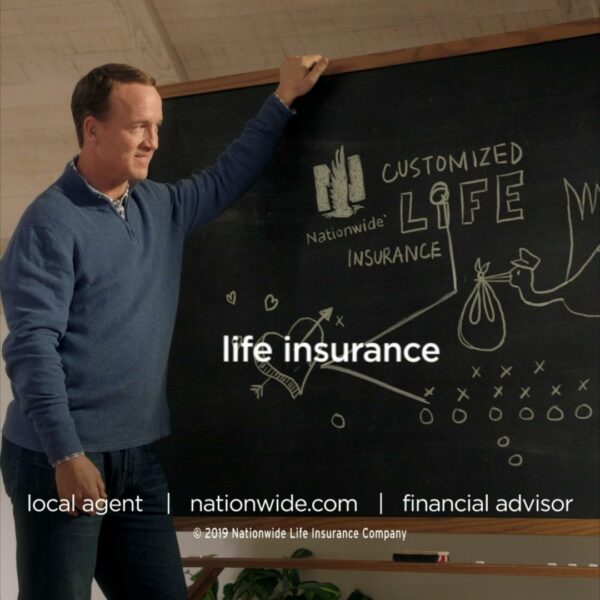

Nationwide Life Insurance Co stands as a beacon of reliability and trust offering comprehensive coverage to suit your needs. When it comes to the types of life insurance products available in the country. There are four basic types of coverage: whole life, universal life, variable life, and term life. Some of the key differences between each of these products are below. If you’re not sure what type of coverage is right for you. Please visit our life insurance buying guide. We will explain the pros and cons of each of the four main types of coverage.

Whole life

You will save more money by buying a whole life insurance policy a term life policy. If you are young or the primary income earner in your family, a term plan may be a better option. The key is to compare different quotes and make sure the policy you’re considering is by a solid company. You can check the financial strength of an insurance company on third-party rating sites.

When choosing a whole life insurance policy, keep in mind that you will have the policy for life. It will provide coverage till your death you can choose your premiums. If you are 100 years old, your premium will stop when you die. If you are under 20 years of age, you can opt for a policy of up to 20 years. Whole-life policies can tailored to meet your specific needs. If you have diagnosed with a critical illness or a chronic illness, you can request an early death benefit.

death benefits, whole life insurance includes a savings component. This component builds cash value time when the policyholder dies. The money is to their beneficiaries. Cash value creates tax-deferred cash value. Which means you don’t have to pay tax on the money. You may have more money in your pocket you think.

Nationwide Life Insurance Company Claims Process. Nationwide, our protection for you extends to a hassle-free claims experience.

Universal life

Universal Life Insurance Company’s financial strength rating remains at B+. The company’s long-term issuer credit rating is B-. The company’s rating reflects adequate operating performance, a neutral business profile, and marginal enterprise risk management. A downgrade to B is possible.

A universal life insurance policy offers two components: death benefit coverage and accumulated cash value. The monthly premium amount is between the two parts of the policy. Some policies offer flexibility with the death benefit, and the policyholder can adjust it to suit his needs. Those planning for the future can opt for a policy with a higher death benefit. Premium will increase. Some policies allow you to extend the death benefit period without increasing the premium.

A nationwide life insurance company address for your peace of mind. The address is located on the insert. Our headquarters is a symbol of accessibility and reliability.

Variable life

Considering a variable life insurance policy? Then you should know some basic terms to better understand what it can do for you. You should know some basic terms to better understand what it can do for you. Consult a financial professional to find out the pros and cons of each type of policy. You also want to understand the fees and costs involved. Variable life insurance policies can vary in price and features. Ask your financial professional for a copy of the policy prospectus to read the fine print. This document outlines the features and benefits of the policy.

The biggest difference between variable and fixed life insurance policies is the cash value they use to manage. The latter is the best choice for people with specific life insurance needs. Variable life insurance policies are not suitable for short-term savings. variable life insurance policy depends on your investment performance, you should pay the premium. If you fail to pay the required premium, the cash value in your policy will decrease. If you don’t have enough money to meet your financial goals, the policy will lapse.

Variable life insurance policies are available from a variety of providers. Nationwide Life Insurance Company offers variable life insurance policies. The price difference is the company’s distribution channels. Nationwide Life Insurance Co. offers a variety of insurance products. It can help you bundle different types of insurance at one low price. If you are looking for a variable policy, talk to a financial advisor and ask for their advice.

Find the assurance of tomorrow in building a resilient and secure future with your spouse with Nationwide Provident Life Insurance Company.

Term life

Nationwide offers four types of life insurance policies. Term life insurance is the cheapest type and usually covers you for a specific period. You can buy nationwide term life insurance with policies like guaranteed level term. It has a range of premium levels and coverage options from 10 to 30 years.

Term life insurance pays a death benefit to the beneficiary in the event of your death. The death benefit is tax-free. The cost of a term policy is low enough to qualify as an affordable life insurance plan for almost anyone. Term life policies are flexible enough to suit your needs and there are no medical examination requirements. Coverage is tax-free. The policyholder can switch to a whole-life policy if he chooses.

A term life insurance policy is an affordable option for many people. The premium amount remains the same for a long time. This type of policy is ideal for young people who don’t need coverage or who can’t afford to pay huge amounts. If you are young, term life insurance is probably a good option for you. Many policies can be into permanent insurance.

Explore competitive Nationwide leaf insurance rates, offering a balance between affordability and comprehensive coverage.

Convertible term life

If you are considering buying a new life insurance policy, one option is a convertible term life insurance policy. These policies can converted to permanent coverage at any time without a medical examination. they do not require a medical exam, you will not have to worry about medical problems. You can take advantage of the renewability clause, which allows you to continue the coverage your term ends. This is important to know as it may result in a higher premium if your health condition deteriorates during the policy.

One of the advantages of the convertible case is that it is portable and chic. Your swaraj continues after you leave your job. If you need a loan for a certain portion, the other way will require a limit. Many cheaper options are convertibles. Portable term life insures many offices do. They can help you choose a policy that fits your needs and budget.

Level term life

The term ‘level term’ refers to most policies offered by Nationwide Life Insurance Company. This means that the death benefit will remain the same throughout the policy term. Many people find this type of policy useful their premium payments will not change if their health changes their life circumstances change. If you are currently working and have some savings. level-term life insurance can be a good option.

Nationwide offers different levels of term policies to suit different needs. Its WL 100 plan has a level premium of up to 100 years. Its 20-pay WL plan lets you pay off the policy within 20 years. Nationwide participates in the jumbo large case life insurance markets. If you are interested in purchasing such a policy, you can check the fine print of the policy and its terms.

Level-term life insurance from Nationwide Life Insurance co is available at reasonable rates and can obtained online or from a licensed agent. There is a comprehensive website with detailed information about their policies and products in the country. The company offers downloadable PDFs for most of its products. You can apply for term life insurance online or for a permanent policy as well. Can schedule a call with a nationwide representative, pay the premium in installments, or mail them.

Nationwide Life Insurance Co of America combines strength and reliability to safeguard families across the nation.

Explore Nationwide Life Insurance Co reviews to witness firsthand the trust and satisfaction of our policyholders.