Nationwide mobile insurance is required. Some of its key features that make it attractive. These include lower premiums, discounts for multi-policy purchases, and monitoring of your driving for four to six months. We will talk about the benefits of multi-policy discounts. Monitor your driving for up to six months and cover unauthorized network charges.

Discounts for multi-policy

A nationwide multi-policy mobile insurance policy offers a variety of benefits. Discounts for multi-policy policies may include accident-free driving and Smart Miles. Many consumers can save more money by staying claim-free and installing an anti-theft device. Other discounts may include safe driving discounts and good student discounts. Some policies may require proof of device installation. These discounts can save you a lot of money be sure to check with the company making any final decisions.

Nationwide offers discounts including safe driving, affiliate membership, and multiple policies. Its multi-policy discount gives customers the option to share the discount with other members of their family. discount, called SmartRide. Some policies offer discounts for young drivers and those with poor credit. Regardless of your situation, you can save money with Nationwide mobile insurance by comparing companies.

You can save money on comprehensive coverage by taking advantage of theft-recovery device discounts and paid-in-full discounts. You can save by combining policies like multi-policy nationwide mobile insurance and multi-vehicle insurance. Discounts may be available for certain states and conditions only. Discounts listed are examples only and may differ slightly from actual discounts. Any logos are trademarks of their respective companies.

Nationwide offers various discounts for multi-car policies. Insure one more vehicle with the company. You can get a multi-car discount. You must have one more car on the same policy. Discounts for multi-policy policies are automatic and do not compound over time. It is worth comparing several quotes from different companies to find the best deal.

Low premiums

If you’re in the market for a new mobile insurance policy, consider comparing the cost of coverage with Geico. Companies that offer low premiums have a nationwide reputation for excellent customer service. Geico is a small company that offers affordable car insurance. is vast across the country. Its rates are competitive. Geico has low rates for all types of drivers. This includes drivers with poor credit and speeding tickets.

Poor credit is a sign that you are high-risk insurance companies charge higher premiums for such people. Nationwide recently raised the average rate of their policy for people with bad credit by $400. If your credit score is above 700, there are other ways to save money. Find discounts that will save you money on your nationwide premium discounts for multiple policies, safe driving good student discounts.

Monitoring your driving for approximately four to six months

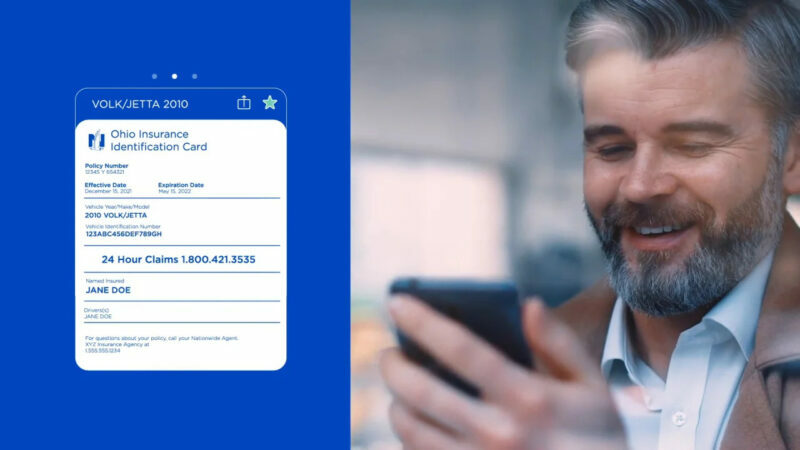

The Nationwide SmartRide app tracks your driving habits. Rewards you with a discount, which rewards you with a 10% discount for signing up. If you maintain a safe driving record, you can get a discount of up to 40% on your policy renewal. The duration of the monitoring is that you can uninstall the application you can choose whether or not to continue monitoring your driving. To continue tracking, your phone must always have location services turned on.

If you decide not to continue monitoring your driving habits, you can return the device for the monitoring period selected. In either case, your current discount will be reapplied. You can choose which of the two offers is better for you at the time of renewal. You can choose to cancel and start your subscription anew with a different discount.

Nationwide SmartRide is a device-based telematics program that tracks your driving for about four to six months. Participants can get up to 40% off their insurance rates as long as they continue to drive safely. The maximum performance discount in the program is twenty-two percent for New York residents and 5% for California residents. If you decide to participate, your rates will remain the same.

Coverage for unauthorised network charges

The best way to find out why your phone insurance policy covers unauthorized network charges is to check the terms and conditions. Most single policies do not cover this, and there are loopholes you should be aware of. The FCA oversees the conduct of businesses in the UK. He found misleading terms and conditions in some mobile insurance companies. Some insurance policies promise to cover your phone if it is stolen or lost not if it is stolen in a taxi. Other coverage descriptions were vague and claims were difficult.

Nationwide mobile insurance is available as part of a FlexPlus account. A FlexPlus account covers the entire household up to PS1,500. Cover for unauthorized network charges extends to accessories. FlexPlus accounts include travel and breakdown cover for the monthly PS13 fee. Visit the Nationwide website. For a limited time, customers can get their mobile phone insurance through a FlexPlus account.

Nationwide mobile insurance cost

When comparing the cost of nationwide mobile insurance premiums, remember that the company may not have the lowest price. Premiums are very competitive compared to other top insurance companies. This is true if you consider its many discount ongoing savings opportunities. We recommend getting free quotes from three other companies deciding. You can call Nationwide Customer Service to get an exact price.

The cost of nationwide coverage depends on what the customer wants. Some options include emergency assistance, theft protection, and roadside assistance. You can choose optional coverages for earthquake flood insurance. Insurance companies offer various discounts and benefits. This includes invisible deductible benefits and discounts for multiple cars. It offers no discounts for airbags, automatic payment, or bundling.

consideration is redundancy. Many policies charge more. Which usually depends on the price of the phone. Regardless of how much extra you pay, this extra cost will make it harder to claim damages. Nationwide mobile insurance has numerous discounts and benefits, which make it worth considering. It is important to check if the policy is right for you and decide which one is right for you. If you want the most comprehensive coverage, you should choose MPID.

Nationwide offers mobile phone insurance through their FlexPlus Current Account. This account provides breakdown cover travel insurance for PS13 per month. Nationwide offers good rates for home motorcycle insurance. Its customer service is above average. Nationwide is an excellent choice if you value quality, competitive premiums, and exceptional customer support. Nationwide Vs. Don’t forget to compare other insurance companies.