Pet insurance rates can vary widely across the country So it is necessary to compare the features and options available. Consider health with a major medical plan, complete pet SM, multi-pet discount, or wellness plan. Additionally, be sure to compare the cost of coverage, deductibles, and various other options. Here are some tips to make your search easier. Read on to find the best nationwide pet insurance rates for you.

Major Medical Plan – Nationwide Pet Insurance

Before purchasing a policy for your dog, consider the deductible and coverage limits. Annual, incident, and lifetime coverage limits can all vary. Annual coverage limits have a single deductible, while per-condition coverage requires you to pay the same deductible each time your dog gets sick or injured. In general, the lower the deductible, the lower the premium. In addition, annual coverage limits will cover unexpected expenses, like vet bills.

Most plans will not cover pre-existing conditions. Most will have a waiting period before coverage will kick in, but some will remove this exclusion after a pre-existing condition has been symptom-free for a certain amount of time. You can also choose an add-on Wellness Plan for your dog. Accident-sickness plans cover accidents and unforeseen illnesses. But it does not cover routine care. A wellness plan can be added to your policy for more comprehensive coverage.

Other major pet insurance companies offer multiple coverage options and deductibles, allowing you to customize your policy to suit your needs. Nationwide, for example, offers a Major Medical policy that covers procedures and treatments for sudden illnesses and injuries, with a $250 deductible. It also offers Whole Pet coverage, which covers unexpected accidents and hereditary and chronic conditions. It is important to note that the coverage is not unlimited and that some companies offer a lifetime renewal option, which may have lower premiums.

Generally speaking, pet insurance policies range from $6 to $155 a month, depending on the animal’s breed, age and pre-existing conditions, and the level of care you want. Policies usually cover accidental injuries and certain types of illnesses, but they do not cover cancer. A pet insurance policy will reimburse for lab fees, prescriptions, and preventative care. If your dog is a cat, you may need a different type of insurance for hereditary conditions.

Major Medical with Wellness Plan -Nationwide Pet Insurance

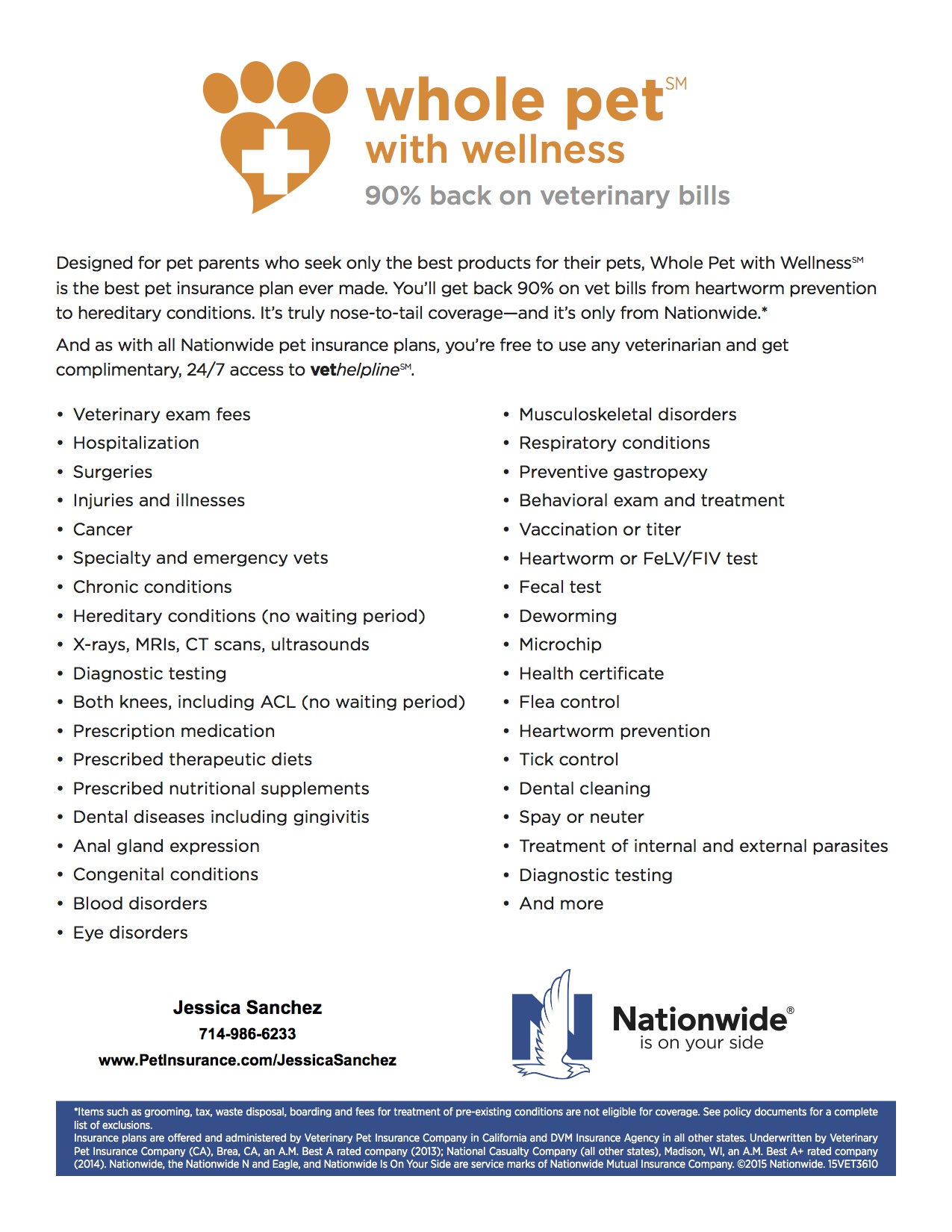

Nationwide offers two main types of pet health insurance policies. The Major Medical with Wellness plan and Whole Pet plan both reimburse up to 90% of vet bills. Both plans cover various medical conditions, such as accidents and illnesses, and provide veterinary helpline access. The Major Medical plan covers in-office exams and in-patient stays, while the Whole Pet plan covers prescriptions and coverage for most congenital diseases. The prices for both plans vary widely, but you’ll get the most coverage for the most money.

The major differences between these plans lie in their specific coverage. The Major Medical plan is generally more comprehensive and covers many common diseases and conditions. Vaccinations and wellness exams are standard benefits for this type of plan, while boarding, grooming, and certain diagnostic tests are not covered. Most pet insurance plans cover only dogs and cats. You should also know what’s excluded, as a Nationwide plan isn’t perfect. You should consider what’s important to you and what’s not.

The Whole Pet plan is similar to the Major Medical plan but covers more conditions. The Whole Pet plan, on the other hand, includes a $250 annual deductible and covers illnesses and injuries. You’ll be able to access a 24-hour vet helpline with a whole pet plan, and your pet’s health is guaranteed. You’ll also benefit from a 24/7 vet helpline, which is vital if your pet gets sick or injured.

Nationwide’s Whole Pet plan has a lower annual deductible than Embrace’s. The two have different deductibles and waiting periods. The Embrace plan covers certain types of surgery, including cataracts and hip replacement surgery. However, it limits the reimbursement for certain diseases and procedures, such as vaccinations and cruciate ligament injuries. Unlike the Whole Pet plan, Nationwide doesn’t cover certain diseases, including cruciate ligament injuries.

A whole pet plan may be better if you have a dog or a cat, and it’s more affordable than a standalone wellness plan. However, you’ll need to have a pet’s health condition before the plan kicks in. Some policies require a 14-day waiting period before you can receive coverage. The Whole Pet plan, however, requires a shorter waiting period and can cover cruciate ligament injuries. However, you won’t be able to file a claim if your dog or cat has a pre-existing condition.

Whole petSM with a wellness plan

Whole petSM with wellness plan nationwide pet insurance quotes cover preventive and wellness care. This type of insurance covers a range of services including dental and eye care, parasite control, nutritional supplements, and pregnancy expenses. While pet insurance also covers some conditions not covered by other policies, such as ear infections. It also covers wellness visits, such as teeth cleaning and flea and tick meds. However, you must be willing to pay a deductible on the first policy.

The Whole Pet plan has more conditions than the Major Medical plan, with a deductible of $250 and a 50 or 70 reimbursement level. It covers many common illnesses as well as cancer. The plan allows you to use any licensed vet in your area and has a $10,000 annual benefit limit. Complete pet plans are available nationwide for dogs and cats before their tenth birthday. But he is waiting for fourteen days for medical treatment.

Nationwide offers a variety of health insurance plans, including Whole Pet with Wellness, which reimburses 90 percent of vet bills. However, it is important to keep in mind that some companies require their customers to have an accident and illness policy before they can be covered by their wellness plan. But Nationwide allows you to purchase their wellness plan without a standard accident and illness policy. If you have a standard policy and want to get full coverage of Whole Pet with a wellness plan, you can look for a cheaper plan online.

Whole petSM with wellness plan nationwide pet insurance quotes will cover some basic procedures, including dental cleanings, but not a spay or neuter operation. The cost of this plan will range from $12 to $18 a month for a wellness plan, but it will cover a maximum of $500 per year for medical bills. This type of plan is available separately or with a Major Medical plan. Nationwide offers both types of plans.

Whole petSM with wellness plan nationwide pet insurance quotes vary based on the type of coverage you need. Major medical plans are more expensive than Whole Pet plans, but they cover a wider range of diseases and illnesses and can help pay for certain vet services. On the other hand, full stomach plans cover a range of procedures, including wellness exams and prescriptions. You can also view the sample policy. which allows you to compare multiple plans side-by-side.

Multi-pet discount

When you purchase coverage for more than one pet, you can receive a multi-pet discount on your policy. Some pet insurance providers offer multi-pet discounts. Such as Prudent Pet and SPOT. These providers offer flexible plans for multiple pets, such as coverage for chronic illnesses and alternative therapies. Additionally, these companies grant a 5% discount to customers who enroll more than one pet. In addition, these companies provide fast nationwide pet insurance claim turnaround time and no entry fee for a multi-pet discount.

Both Pumpkin and Nationwide offer multi-pet discounts, and Pumpkin gives you a 10% discount when insuring more than one pet. Additionally, Pumpkin will give you the full value of their optional wellness package, and both companies cover microchips. Multi-pet discounts can save you a lot of money. And remember, these insurance companies offer customer service that is second to none. With this type of discount, you can have peace of mind knowing your pets are well-protected.

Multi-pet discounts are especially valuable for households that own more than one pet. With Nationwide, you can get a 10% discount for each additional pet. However, you’ll still need to purchase insurance for the remaining pets in the household. This will save you money over time. Considering how much your pets cost, a multi-pet discount can make a difference. There are so many great companies to choose from! Just remember to do your research and compare rates to find the best one for your needs. You’ll be glad you did.

Lastly, remember to check for a multi-pet discount on Nationwide’s policies. This discount will give you even more savings on your pet insurance policy. This discount can save you hundreds of dollars every year. You can get a 5% discount when insuring two or three pets. You can also get a 10% discount when you purchase group coverage through your employer. So, check out Nationwide’s insurance plans today and take advantage of their multi-pet discounts.

A multi-pet discount can help you manage your pet insurance costs for multiple pets. Some insurance providers offer a flat-rate discount if you buy more than one policy, while others offer a specific percentage off once you add the first pet. The discount you get will vary from insurer to insurer, but it’s well worth the added convenience. You’ll be glad you purchased multi-pet insurance when you saw how affordable it can be.