The cost of new driver insurance is generally higher than average. However, drivers who have been insured for several years may qualify for discounts. Many factors influence the cost of new driver insurance. Below, we will look at the top three companies offering coverage and discuss GEICO’s usage-based insurance program. You can also read our full review of the best car insurance for new drivers. Choose a company based on their customer service to get the best deal.

GEICO

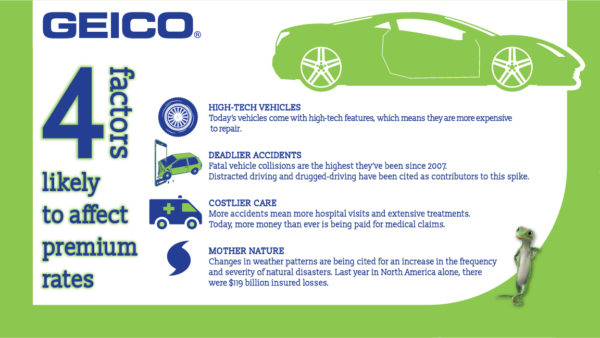

The GEICO new driver insurance cost can vary depending on many factors, including location. Drivers in small towns, for example, will pay less than drivers in Miami, a city that is notoriously dangerous for drivers. Other factors may affect the premium price, too, including your credit score, the type of car you drive, your personal driving history, and how many vehicles you plan to insure. Here are some tips to lower your premium and get the most coverage for your money.

When it comes to car insurance costs, GEICO ranks fourth overall, tied with Farmers. USAA leads the field in customer satisfaction, while State Farm and Nationwide edge out Geico. The good news is that GEICO has a low rate for drivers with poor credit scores. While this is an unfortunate reality for some, it can often be avoided by working to improve your credit score. You can lower your GEICO new driver insurance cost by following these tips.

Another way to lower your GEICO new driver insurance cost is to take a defensive driving class online. A few hours of online instruction can save you anywhere from 5% to 10% on your insurance. Plus, you can pass the test and save money! Remember, the safer your car is, the lower your insurance will be. It’s a good idea to steer clear of fancy sports cars as they’re more likely to be in accidents, and a standard four-cylinder engine is more fuel-efficient.

Geico has low monthly premiums compared to competitors. In one study, researchers studied the premium costs of GEICO and its competitors. Using the age of the drivers, they calculated the average premium amount for each. It turned out that the average cost of full coverage insurance with GEICO is $98 per month, or $1,175. This is a substantial reduction from competitive insurers. In addition to the age of the drivers, gender, and marital status also impact overall insurance cost.

USAA

When you’re looking for new driver insurance, you might be wondering how much the USAA policy will cost. The good news is that USAA has excellent customer satisfaction ratings. The company consistently rates at the top of customer satisfaction surveys conducted by the National Association of Insurance Commissioners (NAIC). USAA has a score of 2.21 out of 5 stars, which is higher than the average industry score of 0.66. However, that score is not indicative of the quality of service you will receive.

If you’re considering getting a new driver insurance policy with USAA, be aware of their introductory offers. They often offer discounts based on a few factors. Among those benefits is accident forgiveness, which can save you a lot of money. In addition, you can qualify for discounts based on your driving history and loyalty to the company. By bundling all of your insurance needs, you’ll save up to 10% on the total cost of your new driver’s insurance.

Another benefit of purchasing a new driver insurance policy from USAA is that you can receive discounts for combining your auto insurance and home insurance policies. You can even get a discount for being a member of SafePilot, a program for safer driving. USAA also gets good reviews in the J.D. Power satisfaction survey, but they don’t make it to the top. Their customer satisfaction ratings are generally high, so you’ll likely have a few issues with them.

If you’re looking for affordable car insurance, USAA has a great selection. Its representative rates and low prices are among the lowest you’ll find in any car insurance provider. And if you’re a member of the USAA, you can take a defensive driving course for an even better chance of getting lower car insurance rates. Regardless of how much your new driver insurance will cost, you’ll have peace of mind knowing you’ll be covered in case of an accident.

Nationwide

The best way to find out how much Nationwide new driver insurance will cost is to compare several quotes. You can also use Insurify to compare quotes from a variety of providers. To start, you can fill out a confidential form. After receiving a few quotes, you can read up on the company’s stats or even save your profile to receive price drops. While this insurer has a long history, you should still check the quality of their local offices.

If you’re concerned about the cost of your new driver insurance, you can always use Nationwide’s accident forgiveness. You can even get a full refund if you’re at fault in your first accident. While Nationwide offers this perk, it does come with a few negatives. First of all, your premium will be higher after your first accident. Nationwide will increase your premium by $1,347 a year before an accident. Next year, that will increase to $2,174, and by the third year, you will pay $3,827.

Besides the discount for good student drivers, you’ll also find a good student discount and accident forgiveness for your first at-fault accident. Nationwide doesn’t increase your insurance rates if you’re at fault in your first accident, and it also has a smart ride usage-based insurance measure that rewards safe drivers. These factors can make a big difference in the cost of new driver insurance nationwide.

The National Insurance Institute says that the number of insurance claims filed by people with poor credit is a definite indication that you’re at higher risk than average. It is not yet known what effect this has on your premiums, but it will certainly affect your cost. The average insurance rate for bad credit drivers in North Carolina and Indiana is $25 higher than a driver with good credit. However, this doesn’t necessarily mean you should ignore your credit score.

GEICO SmartRide usage-based insurance program

A usage-based insurance program tracks your driving habits for a period of 30 days to 90 days and calculates discounts if you drive safely. These programs monitor your speed, hard braking events, mileage, phone usage, and other driving behaviors. They can also help you save on your car insurance premiums by helping you avoid risky situations. Here are some of the benefits of usage-based insurance. You may want to consider signing up for a usage-based insurance program.

A usage-based insurance program may save drivers 15% to 20% per year. However, this is not a guarantee. Depending on your driving habits, you could end up paying more than you have to. To test the effectiveness of the system, you can drive a vehicle with a tracking device. You will receive a quote based on your score. Another usage-based insurance program is pay-per-mile insurance, which focuses on how many miles you drive per year.

The GEICO DriveEasy usage-based insurance program uses an award-winning mobile app to track your driving habits. You can also participate if more than one driver is on your policy. It started as a pilot program in June 2019 and has since been expanded to all consumers. This usage-based insurance program can help you save money on your car insurance premiums, but be sure to keep safe driving habits in mind before signing up.

The GEICO SmartRide usage-based car insurance program monitors drivers for four to six months. The benefits are that those who enroll in the program keep the performance discounts for life. The performance discounts offered by this program are up to 25% in New York, but only five percent in California. The discounts you get are lifetime, and the policy will not be canceled due to a lack of usage.

USAA Pay-as-you-go

One of the most important things to consider when purchasing insurance is how much it will cost. While most car insurance policies have a set price, paying for a different amount each month can save you a lot of money. USAA offers a variety of discounts based on your driving history. Among the most popular discounts are for good grades, multi-policy discounts, and low mileage. You can also qualify for discounts for having multiple vehicles in your household.

When shopping for a new driver’s insurance policy it is important to know that USAA may be the best choice. The company is widely recognized for its excellent customer service and low cost. But you should also consider the policy details. Some policies offer special benefits based on where you live, which may not be an option in every state. USAA’s customer service ranks as highly as its coverage. Many reviewers give high marks to the customer service representatives.

USAA also offers discounts for military members, veterans, and their family members. Those who have served in the military can get discounts for their automobile insurance and home insurance. The company also offers a car storage discount, which cuts your premiums by more than half. It also offers accident forgiveness, which means that your rates will not increase after five years of no accidents. Lastly, if you have a home and auto insurance policy with them, you can save up to 10% on the cost. Lastly, you can get a discount by taking courses on defensive driving.

Another benefit of USAA pay-as-you-go car insurance is its SafePilot program. Unlike other car insurance companies, USAA’s SafePilot program follows the driver’s vehicle. It uses a plug-in device to track the driver’s location. This program is optional, so you must ask your insurance agent about your eligibility. Unlike most other car insurance plans, this one is exclusive to veterans and military personnel.