How much does a Tesla insurance policy cost? tesla model 3 insurance cost is the most expensive Tesla model ever, so how much does insurance cover it? The answer depends on your driving history and your state’s laws. And buying a used Model 3 can be cheaper. The following information will give you an idea of the cost of insurance for this new model. You can save an extra $150 a year by choosing to insure your Model 3 yourself.

What are the safety features of a Tesla?

Tesla cars are versatile with advanced aerodynamic features. Which can help reduce the risk of collision. Tesla models are fitted with numerous cameras. which detects other cars and obstacles on the road. Can automatically brake when needed. Also sets the camera to warn the driver of an impending collision. They don’t hit the car in time.

The Tesla Model S’s Autopilot feature automatically corrects the steering if the car drifts out of its lane or into another lane. The vehicle’s software learns from millions of other vehicles to reduce the risk of collisions. It can also alert the driver when it enters a construction zone. These features attract the driver’s attention. However, the driver may still fail to see the construction zone.

In addition, the Tesla Model S and Model X have undergone testing by the National Highway Traffic Safety Administration, which is the gold standard for vehicles in the United States. According to the report, these vehicles have the lowest crash risk among all vehicles tested by the agency. The car’s low center of gravity, large crumple zone, and airbags all help the vehicle reduce the risk of collision. The car has consistently received top safety rankings.

According to the IIHS, safety features in a Tesla vehicle reduce the risk of a collision by up to 80%. Besides, they are more effective than their counterparts. For example, the Model S received an “excellent” rating. While Model Y remains to be tested. As long as Autopilot is enabled, it can reduce the risk of a collision. However, it’s still a good idea to have the car inspected by safety regulators like NHTSA.

The National Highway Traffic Safety Administration has opened more than twenty special investigations into Tesla crashes. Of those investigations, 24 are pending, including the fatal crash in California last month. A Tesla crash report is expected in the fall of 2020, but there have been no reports of any accidents in Q4 of 2020. However, this Tesla insurance phone number will increase to 131 in 2020 when vehicles start operating in the Southern Hemisphere.

How is the insurance premium calculated?

When you’re shopping for Tesla insurance, keep in mind that the price will vary depending on where you live and what your driving record is. This is good news for Tesla owners, as a clean driving record will help lower premiums. However, insurance premiums vary by location and state. Accident rates, crime rates, and natural disasters also vary by region, which means insurance companies will consider these factors when determining your rate.

The safety score used by Tesla to determine insurance premiums is still in beta and is based on five metrics. The higher your safety score, the lower your premium. This score does not take into account your age or marital status. However, it takes into account factors such as distance to the car in front of you, speed, and whether you are using Autopilot. Your safety score can be viewed on the Tesla app, and it’s important to note that it’s not real-time.

While automakers are trying to enter the insurance industry, Tesla is among the few that have entered. OnStar-branded auto insurance can allow customers to share their driving data with other drivers to qualify for discounts of up to 20%. Insurance companies can use this data to help them make better decisions. How much they are willing to pay for coverage? The benefits of a policy that focuses on driving behavior are significant.

For now, the Tesla insurance product is only available in Texas. But CEO Elon Musk announced plans to expand its offering beyond California and will soon introduce a real-time behavior-based component. The company also introduced a “Safety Score” feature in beta tester cars earlier this month. It is not clear whether the new safety score will be included in your policy. If you decide to purchase Tesla insurance, be sure to shop around for the best policy.

While you may not be tempted to increase your coverage based on your driving history. You should have at least the minimum liability insurance required by your state. However, it’s worth getting more insurance than the minimum required. If you are involved in an accident, consider adding a personal injury protection policy that can cover your and your passenger’s medical bills. However, this coverage is very expensive, and may not be worth it.

Which state has the highest tax rate among us?

If you’re looking for Tesla insurance, you’ve come to the right place. Starting at $887 per year for the new Model 3 if you have a perfect safety score of 100. If your safety score is 95 or higher, your rate will increase to $1,040. The price is higher for the rest of us, but it’s still manageable.

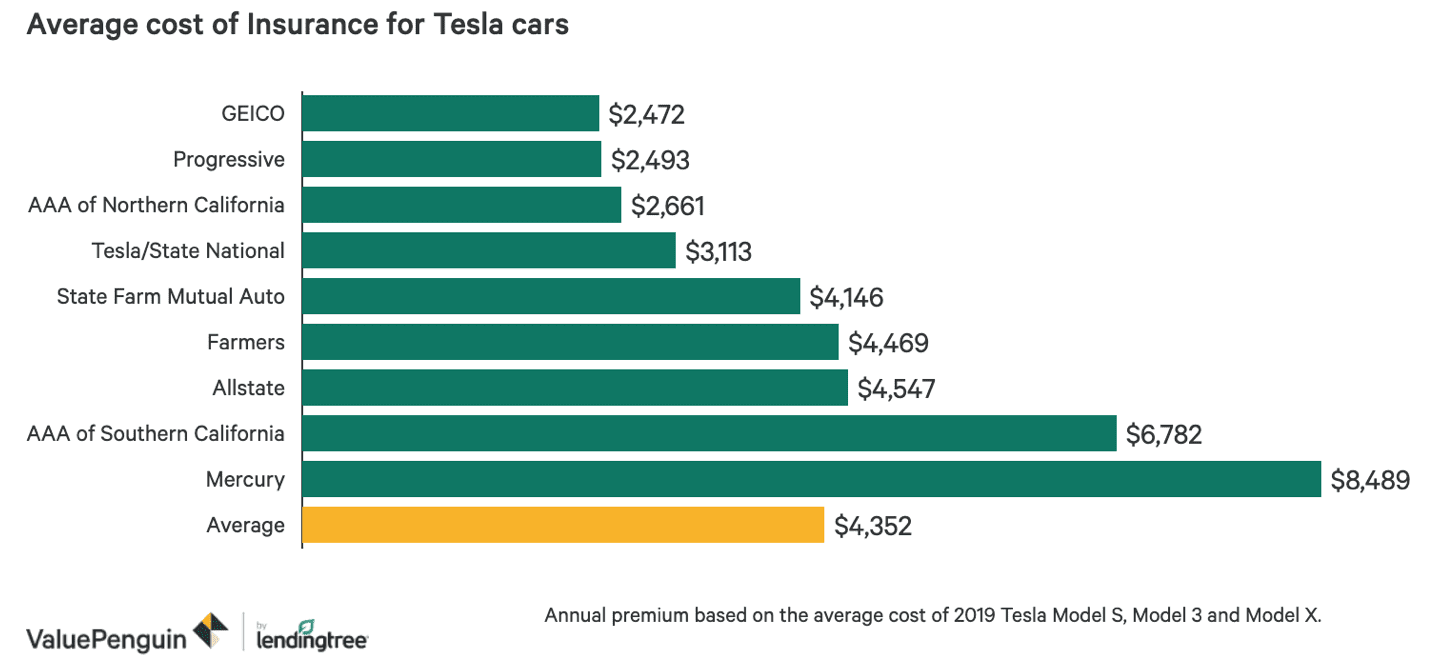

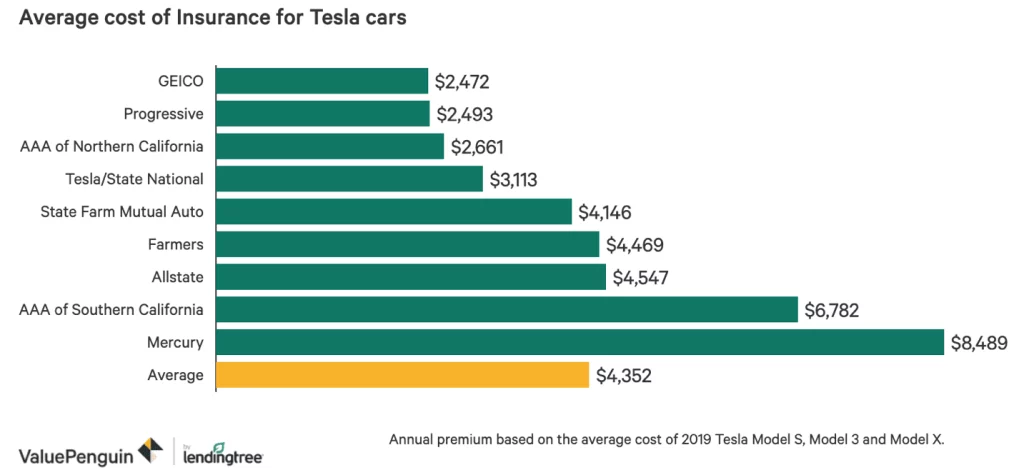

Insuring a Model 3 costs an average of $3,947 a year, but rates vary by insurer and model. Model Y is the least expensive Tesla to insure, as it is a crossover and is, therefore, cheaper to insure than the base model. Insuring a Model X costs $4,275 a year. You can find cheaper rates by using Tesla’s insurance program.

Despite the low average cost of Tesla insurance, it is more expensive than the average luxury sedan. The cost of insuring a Model 3 depends on the base cost of the car, so a cheaper vehicle can have higher rates. Rates also vary depending on whether or not you have discounts or a high-risk status. If you’re in an accident or have multiple vehicles, you can also get uninsured motorist coverage for the other party.

Insurance companies offer several discounts, including student status, low mileage, and where you park the car. Some even provide discounts for being an eco-friendly vehicles. Besides, you can also save money by enrolling in paperless billing or a payment plan with automatic payments. Some insurance for a tesla company will even offer a 5% discount for auto-paying customers. So, if you’re wondering how much your Tesla insurance will cost, make sure you shop around!

When you’re wondering how much Tesla insurance costs, keep in mind that young drivers can charge more for Tesla auto insurance. While a 40-year-old Model 3 driver is charged about $5,588 per year, a teenager is charged twice as much. If you are concerned about the cost of insurance, teenagers may want to consider adding to their parent’s policy as the cost is significantly lower.

Discounts available

Discounts are available for drivers considering purchasing a Tesla. Which is comparable to discounts offered by most other Tesla car insurance companies. Some of the discounts available to Tesla owners include loyalty, good driving, low mileage, and even a 70% discount for new owners. For drivers looking for more discounts, Tesla offers a discount program. Which allows you to save money when you have more than one car. Read on to learn more about how to get a discount on your Tesla insurance policy.

Another way to lower your Tesla insurance costs is by choosing a safety add-on. Model 3 safety features are how much insurance companies charge. There is a large portion of it and you want to pick it up if you can. The Autopilot feature is one of Tesla’s safety add-ons. And it can save you as much as five to ten percent on your insurance premium. Similarly, your driving record will play an important role in determining your insurance premium. Major violations or minor speeding tickets can raise your insurance premium.

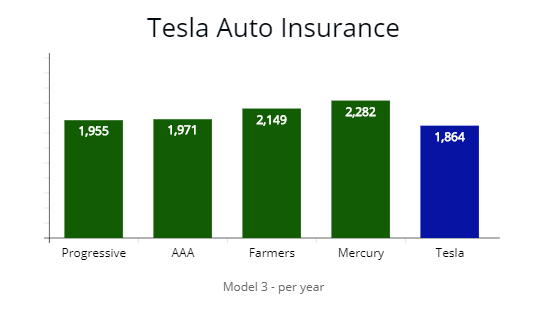

However, Tesla insurance can be more expensive than national carriers. It is cheaper if you can pay for the entire cost in one go. In addition to discounts for multiple cars, Tesla will use its built-in telematics systems to price each car. The only downside of this insurance plan is that you have to buy it directly from the company. However, in the case of a car accident, it is worth the price.

The Model 3 is the best-selling vehicle in Tesla’s history, accounting for over 70 percent of all sales. It was the first plug-in electric vehicle to overtake the Nissan Leaf in less than three years. The Model 3’s compact size, good highway safety ratings, and low insurance premiums have made it a popular choice for many consumers. Its insurance premiums are also lower than average vehicles. Because replacement parts for Tesla cars are much less expensive than for other vehicles.