To get a general insurance auto quote You should know that a cancellation fee or 10% unearned premium is usually charged on canceled policies. A reinstatement fee is charged if you are not satisfied with your insurance policy. Listed below are some things to keep in mind while getting a quote from General Insurance.

Getting a free car insurance quote

If you’re in the market for a new car, it’s always worth getting a free car insurance quote. Having a good understanding of your auto insurance coverage is important as this is a key budgeting consideration. Shopping for a car insurance quote does not affect your credit score. Be aware that a bad credit score will increase your quote in states like Massachusetts, Hawaii, and Michigan.

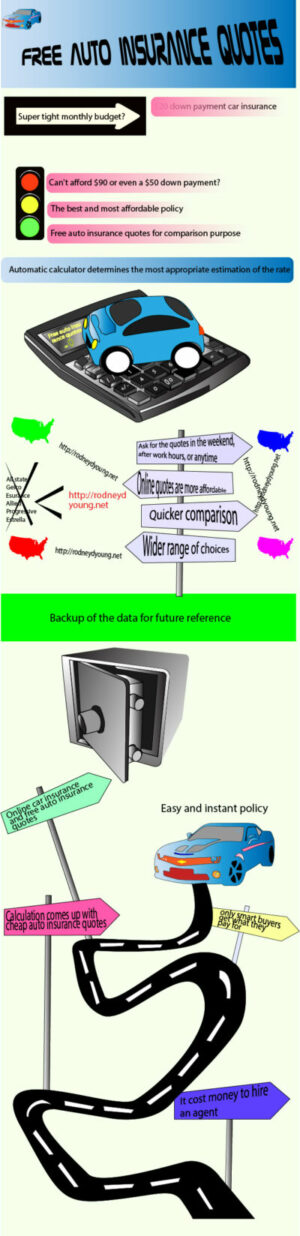

Free car insurance quotes can be obtained online or by calling toll-free numbers. Insurance brokers also offer free quotes for new and existing customers. A licensed insurance broker is an independent insurance agent who does not work for a specific company. Once you have a few quotes, you’re ready to make a decision. The best way to get a free car insurance quote is from an online insurance agent.

Some of these factors are your driving history, location, car type, driving history, and more. Like whether or not you smoke, or if you use any illegal drugs. Once you’ve chosen your insurer, you should use that information to compare prices.

Getting a quote online

General insurance auto quotes vary widely. Liability auto insurance, for example, will compensate you if you are involved in an accident with a negligent party who is driving without insurance. Most insurance companies offer an online quote tool for this type of insurance. Getting a general insurance auto quote online is also easier than ever and many insurance companies offer free auto quotes. If you would like to get a general insurance auto quote, simply fill out the form below.

Getting a general insurance auto quote online is a convenient way to get free quotes from multiple insurance agents. Talking to an agent before signing up for a policy is still the best way to get the best deal. Getting a general insurance auto quote online is all about collecting as many quotes as you can. Once you have collected the quotes, you can compare them to find the best car insurance company.

Before you start shopping for car insurance, you should know your vehicle’s VIN. The VIN is usually located on the dashboard or in the door jamb. Also, you should know the odometer reading for your vehicle. This information is important when choosing a general insurance auto quote online. Most car insurance comparison websites will allow you to enter information about your vehicle in less than a minute.

The process of buying car insurance online is almost the same for all companies. Some insurance companies offer instant car insurance quotes. While others ask for contact information before giving a quote. You should get three quotes from at least three insurance companies before settling on the best option. Many insurance companies offer live help and support. Most websites allow you to complete the entire process online.

Calling for a quote

One of the most common mistakes made when calling for an auto insurance quote is not understanding how to follow up with a lead. Most insurance leads and calls end in a single close. Some callers will hesitate to make a decision right away and want to talk to a friend or family member before making a decision. If the caller wants to get a general insurance auto quote. Follow up on the lead so that the lead or caller has a positive experience.